Swift Rupee loan app Review : Swift Rupee loan Real or Fake

Swift Rupee loan App Review :- Swift Rupee is Fake instant personal loan app, It Gives only 7 days loan tenure Which Very Short and Charge Very High interest Rates, Don’t Apply in This loan app if You want to take loan from NBFC Registered loan app then I will Give Direct link of that loan apps

Swift loan app Review में हम जानेंगे इस सवालों के जवाब

- Is Swift Rupee 7 days loan app ?

- Is Swift Rupee NBFC registered loan app ?

- Is Swift Rupee loan app RBI approved ?

- Can Swift Rupee hack our Contact lists ?

- Can Swift Rupee Hack our Gallery ?

- Swift Rupee loan not paid what happens ?

Swift Rupee instant loan : Basic Details

- Swift Rupee loan amount :-from 5000₹ to 5 lakh Rupee but in reality they Give You loan below 20k

- Swift loan app Tenure : 91 days to 120 day but that’s not true they Give only 7 day loan

- Swift Rupee loan APR ( Rate of interest ):- 18.25% which wrong they charge 40- 50% in week

- Swift instant personal loan app has 100K+ Download most of the download comes from Google and Facebook ads

- Swift instant loan app rating : 4.5 star with 3k Reviews

ये भी जाने रजिस्टर्ड लोन ऐप के बारे में

| पर्सनल लोन ऐप | आवेदन करें |

| बिजनेस लोन ऐप | आवेदन करें |

| 50,000₹ का लोन | आवेदन करें |

| 10,000₹ का लोन | आवेदन करें |

Swift Rupee loan : Eligibility Criteria & Documents

- Indian Residents only

- 18- 52 year age group

- Have a stable Job

- Aadhar Card for address Verification

- Pan card

- Active bank account for disbursement

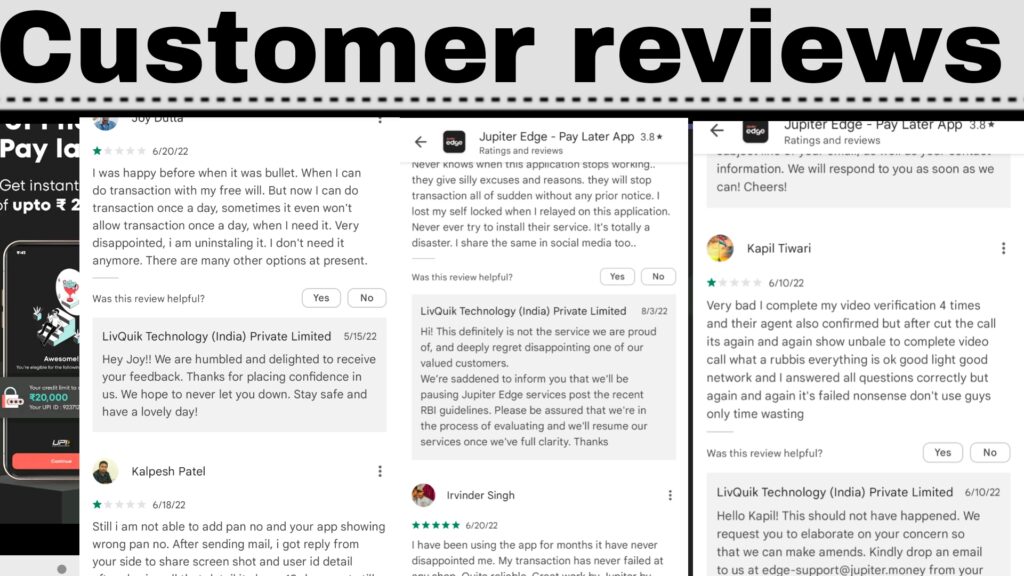

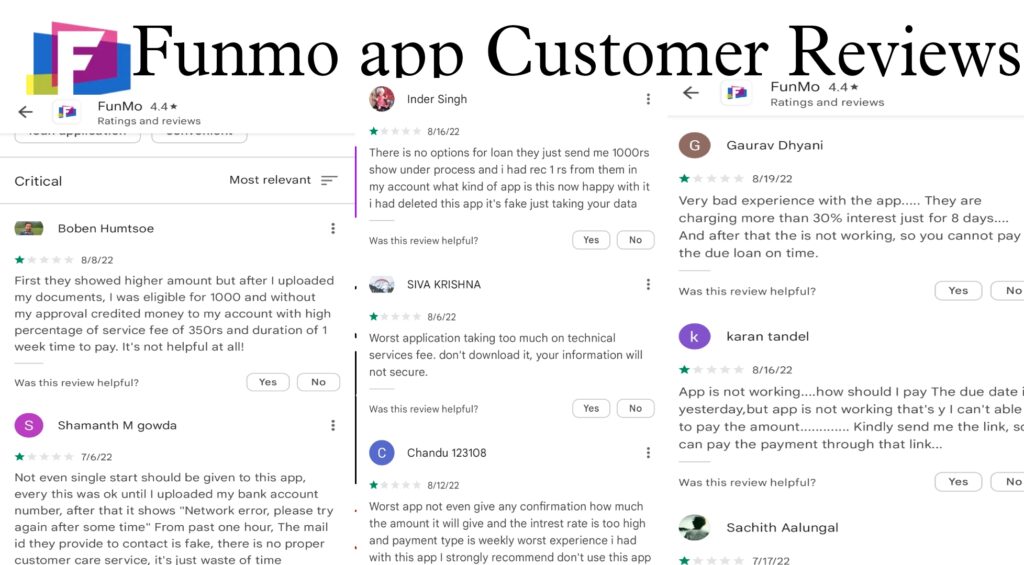

Swift loan Customer Reviews : Swift instant loan

- Yes Swift loan app is 7 days loan app Don’t apply

- Yes They charge almost 40-50% of loan amount

- Swift loan app Has no Customer Support team

- Swift loan is RBI approved loan app

- Swift loan app has no NBFC

Swift loan app Complaint || Swift loan app Harassment

- You can File a Complaint in Cyber-crime online

- You can File complaint in your nearest police station

- Don’t Repay a single penny of this loan app

- Alert Your Contact and Your Family Friends about this loan app