30,000₹ Urgent Cash Loan From New Loan App 2025

Are you looking for a fast and convenient way to get a small loan? Today, I’m sharing my experience with a new loan app that has been gaining attention for its quick loan approvals and easy process. I recently got a small loan approved through this app, and I’ll also dive into its features, eligibility criteria, documentation requirements, and customer reviews to give you a balanced perspective. Stick around to find out the name of this app at the end!

My Experience with the Loan App

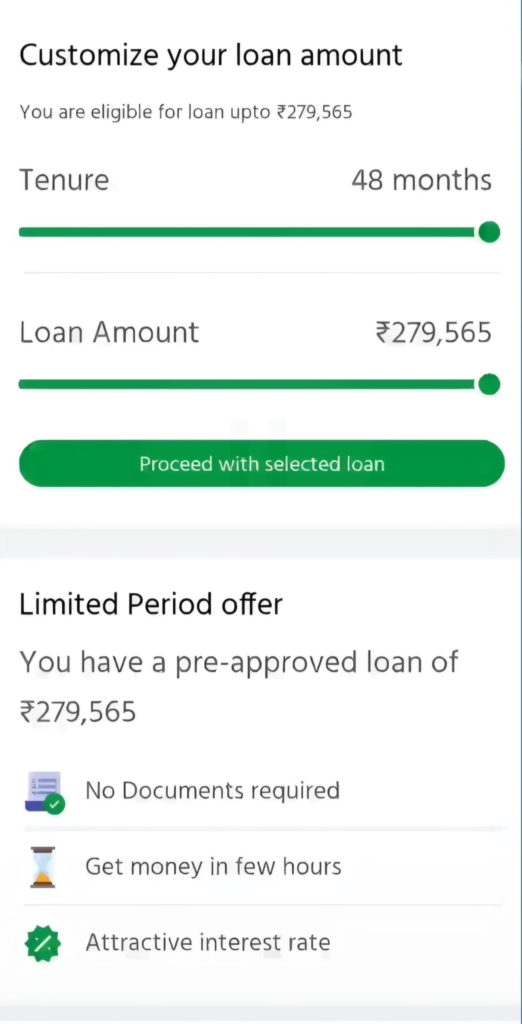

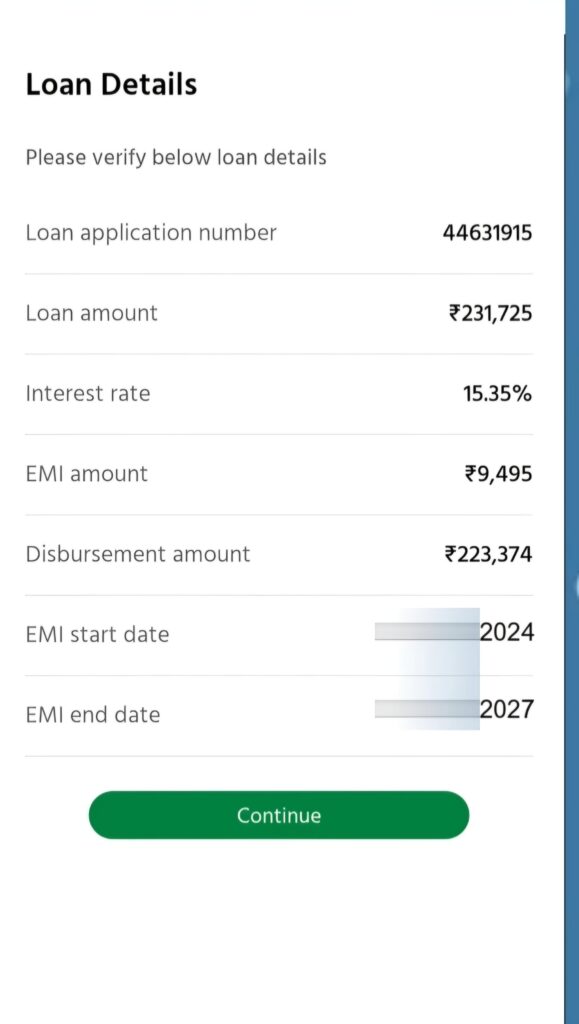

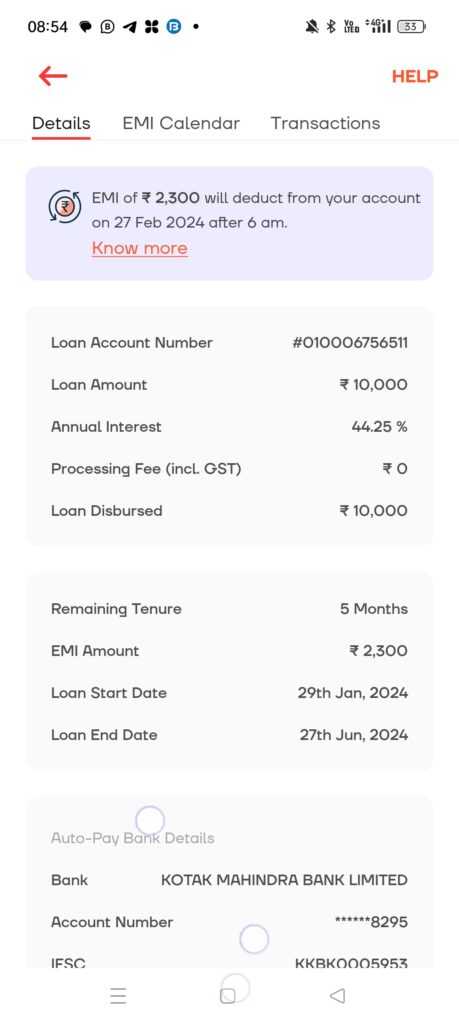

I needed a small loan to cover some urgent expenses, and this app came to my rescue. I applied for a loan of ₹1,300, and to my surprise, the approval was almost instant. The process was straightforward – I filled in my details, and on 14th May 2025, the loan was approved with an order number 42951222. The transfer amount I received was ₹1,258 after deductions like a ₹30 loan coupon, ₹35 document fee, ₹16 interest, and ₹7 GST, making the total repayable amount ₹1,562 over a 28-day repayment plan with 2 terms. While the disbursal was quick, the fees and interest did add up, so it’s something to keep in mind.

Basic Features of the App

This loan app offers a simple and fast way to borrow money. Here are some of its key features:

- Instant Loan Approval: Loans are approved within minutes, often as fast as 20 minutes after application.

- Paperless Process: The app provides paperless personal loans of up to ₹25,000 with minimal documentation.

- User-Friendly Interface: The app is easy to navigate, available in English and Hindi, and works on Android 13.0 and above.

- Quick Disbursal: Funds are transferred to your account shortly after approval, sometimes in as little as 15 minutes.

- Transparent Breakdown: You get a clear breakdown of fees, interest, and repayment terms before taking the loan.

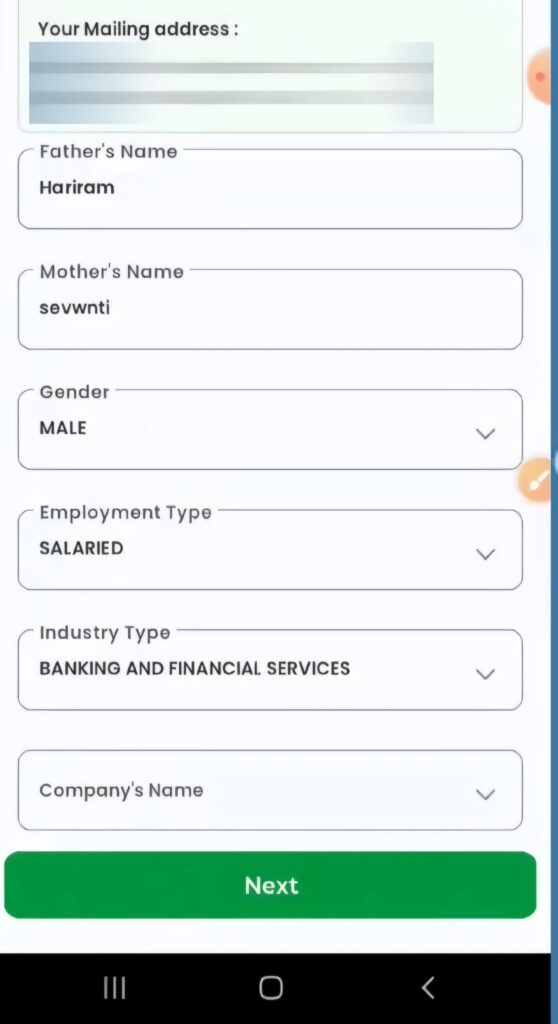

Eligibility Criteria

To apply for a loan through this app, you need to meet the following requirements:

- Be an Indian national.

- Be over 18 years of age.

- Have a steady source of income on a monthly basis.

- Ensure your mobile number is linked to your Aadhaar card.

- Have a CIBIL score above 700 with no pending loans.

Documentation Required

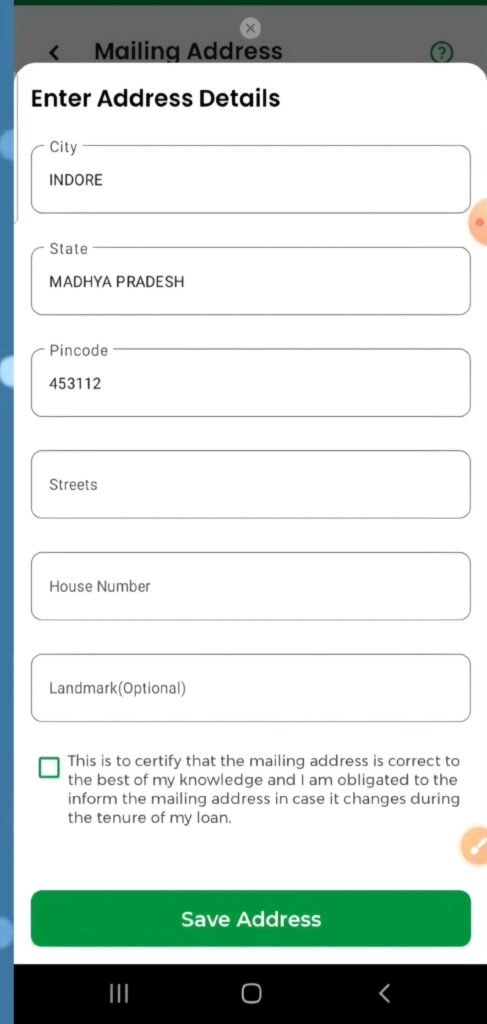

The app keeps documentation minimal to make the process quick. You’ll need to provide:

- Aadhaar card and PAN card for KYC verification.

- A selfie for identity confirmation.

- Bank statements to show a stable income source.

- Additional documents may be required for higher loan amounts, as mentioned in the app.

What Makes This App Stand Out?

This app is designed for people who need instant cash for emergencies. The paperless process and quick disbursal make it convenient, but the fees and short repayment periods can be a challenge, as I experienced with my loan.

Customer Reviews: The Good and the Bad

To give you a better idea, let’s look at what other users have said about this app.

Positive Reviews

- Kuldeep Sharma (10/05/25): “Great Experience! I’ve had a smooth and hassle-free experience using this app. The interface is user-friendly, and the loan process is quick and transparent. I was able to get the funds I needed within minutes, and the repayment options are flexible and clearly explained. Customer support is responsive and helpful. I highly recommend this app for anyone looking for a reliable and fast financial solution.”

- Khan Awais (27/03/25): “Instant loan, good experience. One of the best apps I’ve been using for a few months now. The app is incredibly user-friendly, with a seamless interface that makes it easy to navigate and apply.”

- Jignesh Palas (04/05/25): “Very good, I am so happy! Money came into my account very easily. This application is amazing. Money gets transferred to the account in just 15 minutes. This app works very well for loans.”

Critical Reviews

- Nirbhay Shukla (20/03/25): “I took a ₹24,000 loan, but the interest rate was very high. The one-month repayment schedule caused issues, and a single-day EMI delay led to a late fee and a severe CIBIL score impact without prior notice. Their customer support is terrible – no response despite multiple calls. I strongly urge others to consider better loan apps with smoother processes.”

- Musthafa NP (02/05/25): “I was a loyal customer who always repaid on time. But after repaying a ₹26,000 loan early, my next three applications were rejected without reason. Support gives copy-paste replies. Completely unfair system. Not recommended for genuine users.”

- Priyanka Nair (01/05/25): “I would not recommend this app unless you’re desperate. For a ₹27,000 loan, they asked for ₹35,000 repayment within a month – that’s almost ₹7,500 in charges! Other apps charge much less. Choose wisely, or you’ll end up in more debt.”

Should You Use This Loan App?

Based on my experience and the reviews, this app is a mixed bag. If you need a small, quick loan and can repay on time, it might work for you, as the approval process is fast and the app is easy to use. However, the high interest rates, additional fees, and strict repayment schedules have caused issues for many users. Customer support also seems to be a weak point, so proceed with caution.

The Big Reveal: The App Name

The loan app I’ve been talking about is PayRupik. It’s marketed as a quick financial solution, but as the reviews suggest, it may not be the best choice for everyone. If you decide to try it, make sure to calculate the total repayment amount and ensure you can meet the repayment terms to avoid penalties.

Final Thoughts

PayRupik can be a lifesaver for small, urgent loans, as I experienced with my ₹1,300 loan approval. Its features like instant approval and minimal documentation are appealing, but the high costs and mixed customer feedback highlight the need to explore other options as well. Always compare loan apps, read reviews, and check the terms before borrowing to make an informed decision.

Have you tried PayRupik or any other loan apps? Let me know your thoughts!