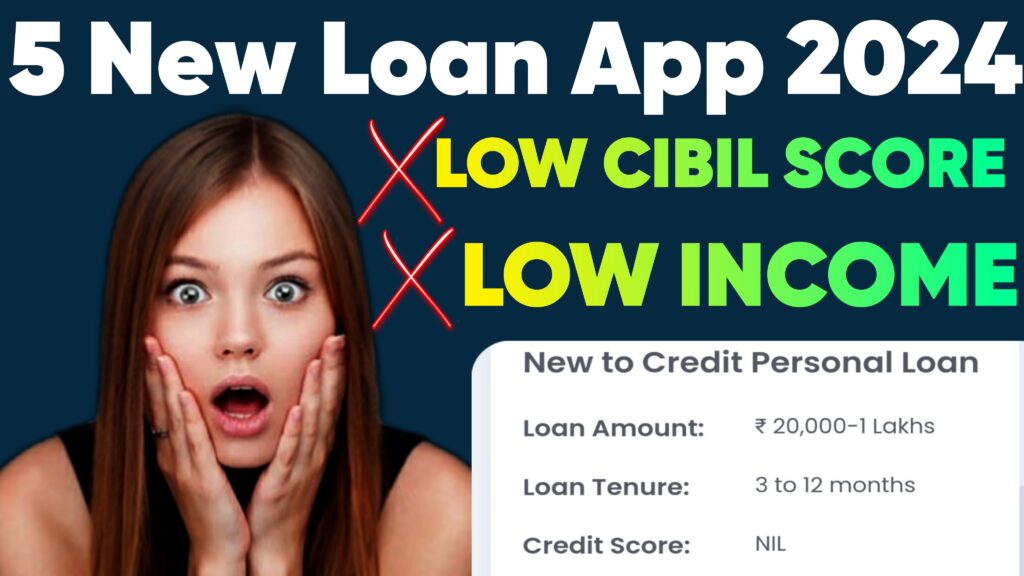

5 NEW LOAN APP 2024 : Best Loan App

if you want to take loan from new loan applications which are launched in 2024 then this is the best post for you because in this post I will tell you how can you take loan from newly launch loan application in Play Store and best part of this is not sponsered post. Today we talk about 5 new loan app 2024 today this will very helpful and informative if you wanna take personal loan

1. FINSARA PERSONAL LOAN : NEW LOAN APP

Finsara application is newly launch loan application in 2023 and this loan application gives you lonely stinkly up to 5000 and this will also give personal loan when you take credit limit for 3 to 4 months then automatically they gives you personal loan offer to 100000 Rupees And best part of loan application is there is no need to Income prove and salary slip you have to only submit your PAN Card Aadhar Card and bank statement

2. BetterPlace Money Loan App

better place money loan application is also a new loan application which is launched in 2023 and this application gives you loan instantly up to 25000 for up to 12 months and the best part of this loan application there is no need to income proof and salary slip

3. Taplend Loan App: New Loan App 2024

taplend personal loan app is small personal loan app and this loan app is working for all (salaried and self employed loan app) this loan app is working like a level because this application gives you small loan in starting and after you will repaid the loan and after that you will get higher limit

4. Indie Personal Loan App: new loan

indie loan application is new loan application and this application is launched by bank of in the IndusInd Bank at this is best application because this gives you credit line up to 500000 and best part of this loan application there is no need to submit any document like income proof salary slip bank statement because this is a banking application and it gives you saving account at zero cost

5.fatakpay loan app

fatak pay is new loan app and it gives you ticket loan size like 10k to 100k and this app is working for both salaried and self employed employees

Know About : Top 30 Best Loan App 2024