Buddy Finance Loan App Review 2025: Exposing the Fake Loan Scam

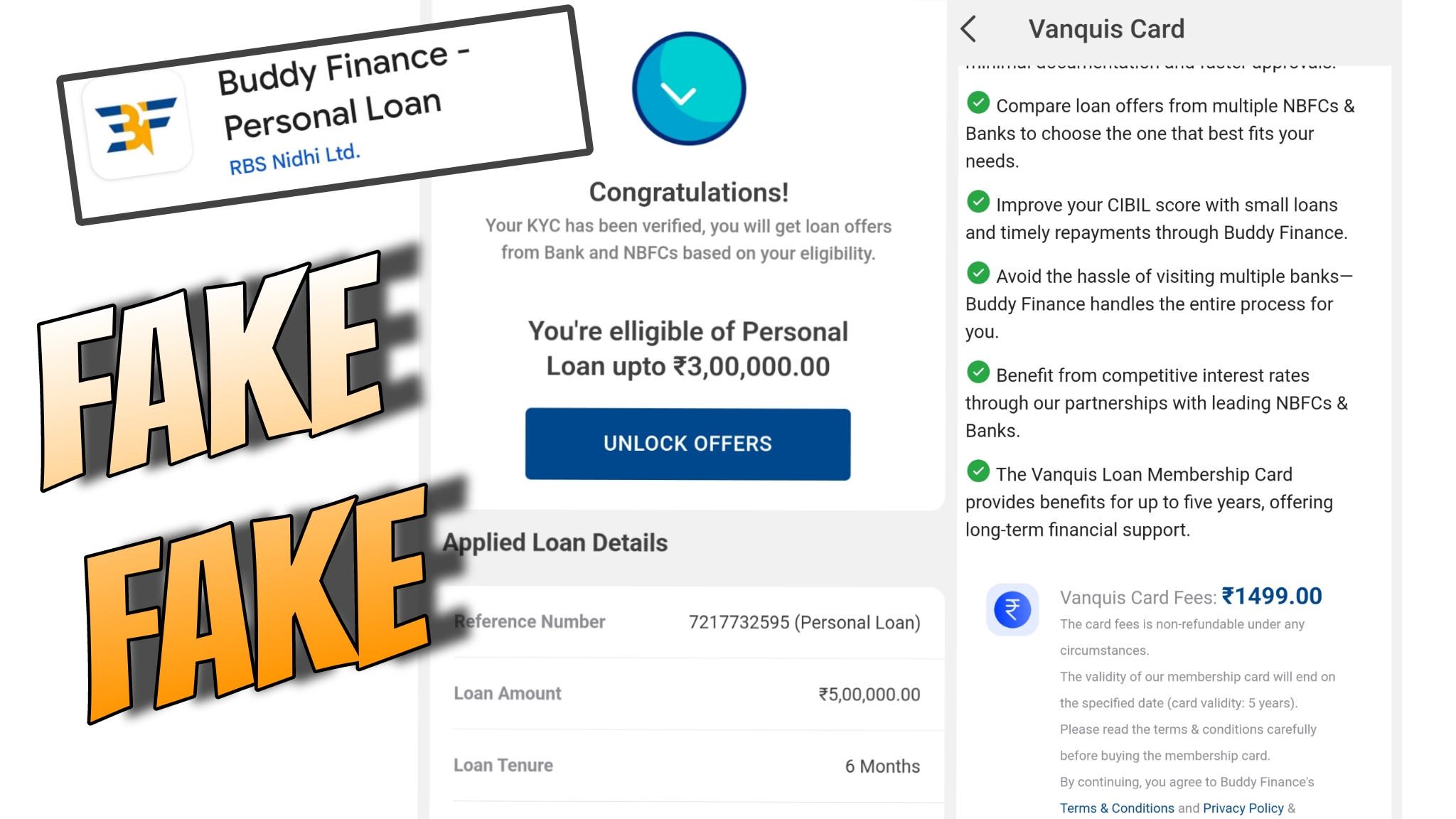

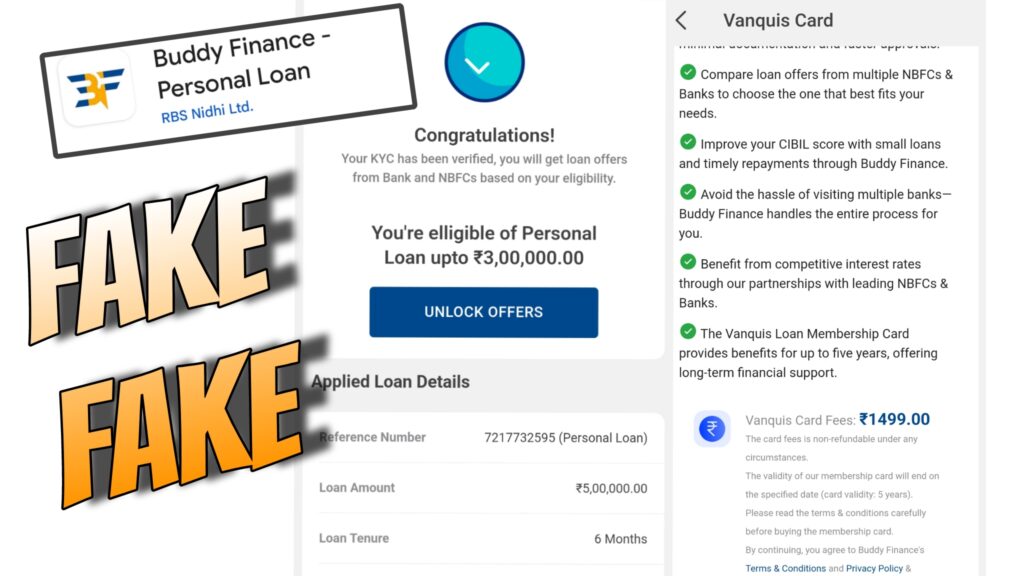

In the crowded world of digital lending apps, Buddy Finance Loan App stands out on the Google Play Store with an impressive 4.9-star rating and over 1 lakh downloads. Promising instant personal loans up to ₹25 lakhs and business loans up to ₹2 crore, it lures users with claims of a seamless, paperless process and partnerships with RBI-registered NBFCs. However, beneath this shiny exterior lies a fake loan scam designed to trap unsuspecting customers. Charging a ₹1,499 subscription fee for its “Vanquis Card” and then failing to deliver loans, Buddy Finance is a classic example of a fraudulent app exploiting desperate borrowers. In this Buddy Finance Loan App review 2025, we’ll uncover the truth and expose this scam with real customer experiences and hard facts.

What Is Buddy Finance Loan App?

Buddy Finance markets itself as a reliable platform offering quick personal and business loans with minimal paperwork. It boasts features like the exclusive Vanquis Card (priced at ₹1,499), competitive interest rates starting at 12.99% per annum, and a transparent process partnered with RBI-registered NBFCs like Storrose Vyapaar Pvt. Ltd. The app promises loan approvals in under 5 minutes, flexible repayment tenures of 6 to 60 months, and no hidden charges—an enticing deal for anyone needing urgent funds.

But here’s the catch: Buddy Finance is a fake loan app that collects a ₹1,499 membership fee and then leaves customers high and dry, with no loan disbursed and no support forthcoming. Despite its polished Play Store description, the app’s operations reveal a predatory scheme aimed at defrauding users.

Buddy Finance Loan App: Promises vs. Reality

Let’s dissect Buddy Finance’s claims and compare them to the harsh reality faced by users

1.₹1,499 Vanquis Card Membership

- Claim: Pay ₹1,499 for the Vanquis Card to unlock pre-approved loan offers, faster processing, and exclusive benefits.

- Reality: After paying the subscription fee, users like Ujwala Naik and Nikhil Mane report that their membership remains “Inactive,” and no loan is credited. The fee appears to be a ploy to extract money without delivering services.

2.Instant Loans Up to ₹25 Lakhs

- Claim: Personal loans up to ₹25,00,000 with approval in 5 minutes.

- Reality: Customers who paid the ₹1,499 fee, expecting loan disbursal, received nothing. The promise of instant credit is a bait to hook users into paying upfront.

3.Transparent Process with No Hidden Fees

- Claim: No hidden charges, with processing fees clearly outlined (e.g., ₹1,500 + ₹270 GST for a ₹50,000 loan).

- Reality: The ₹1,499 subscription fee itself is a hidden cost, as it’s mandatory for loan eligibility but doesn’t guarantee approval or disbursal. Users are left out of pocket with no recourse.

4. Partnership with RBI-Registered NBFCs

- Claim: Buddy Finance collaborates with trusted NBFCs like Storrose Vyapaar Pvt. Ltd. for secure lending.

- Reality: There’s no verifiable evidence that Storrose Vyapaar Pvt. Ltd. is actively involved. Fake apps often name-drop legitimate entities to appear credible while operating outside regulatory oversight.

5. Responsive Customer Support

Claim: Reach out at support@buddyfinance.in for assistance.Reality: Multiple users report zero response to emails and calls, leaving them stranded after payment. This lack of support is a hallmark of a fake loan scam.

Real Customer Reviews

Expose the FraudHere’s what actual users are saying about Buddy Finance on the Play Store in 2025:

Ujwala Naik (26/12/24)

“I paid ₹1,499 for the membership card, but my status still shows Inactive. I’ve emailed and called multiple times—no response. Seems like they’re scamming for money. Fake app, lost my money.”

By ujwala naik

Nikhil Mane (27/01/25)

“I paid ₹1,499 for the card, but my loan amount wasn’t credited. Emailed customer support—no reply. This is a big scam. Biggest fraud application, don’t apply!”

These reviews highlight a pattern: users pay the subscription fee, expecting a loan, only to be ghosted by Buddy Finance. The glowing 4.9-star rating and 1 lakh downloads? Likely inflated with paid reviews, a common tactic among fraudulent apps to build trust.

👇👇👇Apply Most Trusted Loan👇👇

with 100% Approval only Aadhaar Card

Buddy Finance Loan App Review 2025: Final Verdict

This Buddy Finance Loan App review 2025 exposes it as a fake loan scam preying on unsuspecting users. Its attractive Play Store description—promising ₹25 lakh loans, low interest rates, and a seamless process—is a façade to justify the ₹1,499 subscription fee. Once paid, users are left with an inactive membership, no loan, and no support. The 4.9-star rating and 1 lakh downloads are likely fabricated, masking a predatory scheme that’s fleeced countless victims.

Don’t fall for Buddy Finance’s trap. If you need a loan, choose RBI-regulated apps with proven track records. Buddy Finance is a fraud—stay away and save your ₹1,499!

Keywords: Buddy Finance Loan App review 2025, fake loan app, Buddy Finance scam, ₹1,499 subscription scam, fake loan app India 2025, expose Buddy Finance fraud, beware Buddy Finance.