Niro Loan App: Pre Approved Loan App Instantly

Kya aapko kabhi aisa laga hai ki life ke plans ke liye thodi si extra financial help chahiye? Chaho wedding ka kharcha, medical emergency, ya phir dream vacation, Niro Loan App hai apka one-stop solution! Yeh app India mein personal loans ko banata hai super easy, fast, aur hassle-free. To chaliye, jante hai iske baare mein ek unique aur SEO-friendly tareeke se!

Niro Loan App Kya Hai?

Niro ek digital platform hai jo salaried aur self-employed logon ke liye instant personal loans provide karta hai. Yeh koi bank ya NBFC nahi hai, balki trusted lending partners ke saath milke aapko loans dilata hai. App ke through aap anytime, anywhere loan apply kar sakte ho, aur paise directly apke account mein aa jate hain. Simple, fast, aur transparent!

Key Features of Niro Loan App

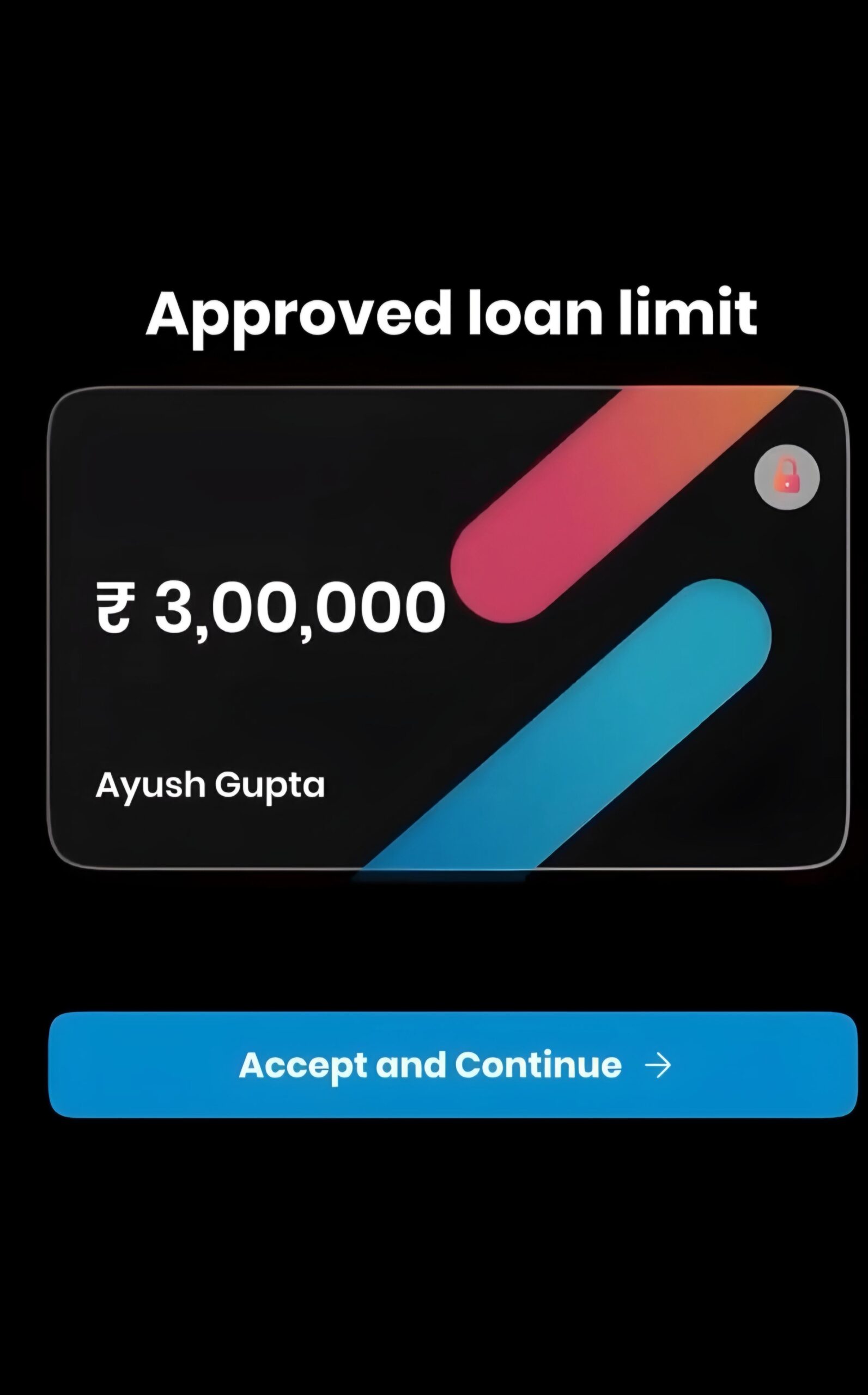

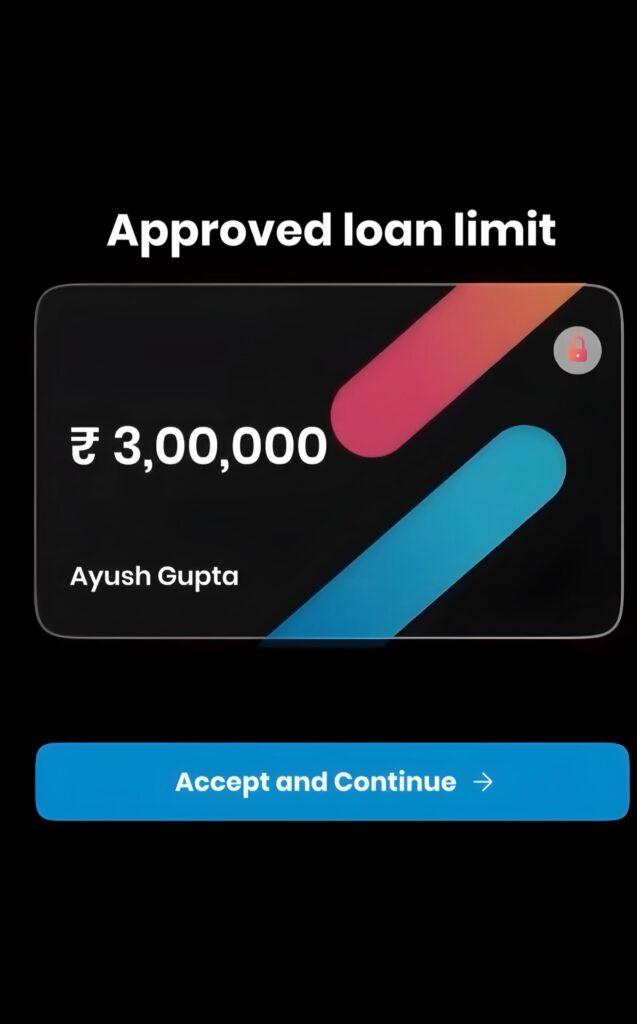

- Loan Amount: ₹50,000 se ₹3,00,000 tak.

- Interest Rates: 12% se 32% per annum (reducing balance basis pe).

- Tenure: 6 se 36 months tak flexible options.

- Processing Fees: 1.5% se 8.9% (minimum ₹750 + GST, maximum ₹8,900 + GST).

- Instant Approval: Quick process, no lengthy paperwork.

- Trusted Partners: NDX P2P (Liquiloans), PayU Finance, Muthoot Finance, L&T Finance, Aditya Birla Capital, aur Kisetsu Saison Finance jaise reputed lenders ke saath tie-up.

Kaise Kaam Karta Hai Niro Loan App?

Niro ka process itna simple hai ki aap ghar baithe loan le sakte ho! Bas app download karo, apni details fill karo, aur apki eligibility ke basis pe loan offers choose karo. Sabse badi baat – aapko loan dene wala lending partner ka naam clearly dikhaya jata hai jab aap terms select karte ho.

Loan Calculation Example

Let’s break it down with a real example:

- Disbursal Amount: ₹1,20,001 (yeh amount apke account mein aata hai).

- Monthly EMI: ₹9,975.

- Interest Rate: 19.99% per annum (reducing balance).

- Tenure: 14 months.

- Processing Fee: 2.5% of loan amount = ₹3,091.

- GST on Processing Fee: 18% of ₹3,091 = ₹556.

- Total Loan Amount: ₹1,20,001 + ₹3,091 + ₹556 = ₹1,23,648.

- Total Amount Repaid: ₹9,975 x 14 = ₹1,39,650.

- Total Interest Paid: ₹1,39,650 – ₹1,23,648 = ₹16,002.

Repayment Schedule:

- 1st EMI: 2nd Jan 2022

- 2nd EMI: 2nd Feb 2022

- Loan Ends: 3rd Feb 2023

Penalties for Delayed Payments

EMI time pe nahi bhari toh lending partner ke rules ke hisaab se penalty lag sakti hai. Plus, har bounce ke liye ₹499 ka one-time flat fee bhi charge ho sakta hai. To always pay on time and stay stress-free!

Why Choose Niro Loan App?

- Flexible Loans: Chhota ho ya bada, apki zarurat ke hisaab se loan amount aur tenure choose karo.

- Transparent Process: No hidden charges, sab kuch clear aur upfront.

- Quick Disbursal: Apply karo, approve hua, aur paise account mein!

- Trusted Partners: Top lenders ke saath tie-up, to reliability guaranteed.

- User-Friendly App: Simple interface, no tech headache.

Niro Ke Lending Partners

Niro partnered hai India ke top financial institutions ke saath, jo ensure karte hain ki aapko safe aur reliable loan mile:

- NDX P2P Private Limited (Liquiloans): https://www.liquiloans.com/affiliates

- PayU Finance India Pvt. Ltd.: https://www.payufin.in/

- Muthoot Finance Limited: https://www.muthootfinance.com/personal-loan

- L&T Finance Limited: https://www.ltfs.com/our-products/consumer-loan

- Aditya Birla Capital Limited: https://finance.adityabirlacapital.com/our-digital-lending-platform-partners

- Kisetsu Saison Finance (India) Pvt. Ltd.: https://creditsaison.in/partnercontact/

Niro Loan App Kaun Use Kar Sakta Hai?

- Salaried Individuals: Regular income wale employees ke liye perfect.

- Self-Employed: Business owners ya freelancers bhi easily apply kar sakte hain.

- Credit History: Aapka credit score decide karta hai exact interest rate aur terms.

Niro Loan App Users

Agar aap Niro ke baare mein search kar rahe ho, yeh keywords use karo:

- Instant personal loan app India

- Niro loan app review

- Best loan apps for salaried professionals

- Quick loans with low interest rates

- Personal loan without paperwork

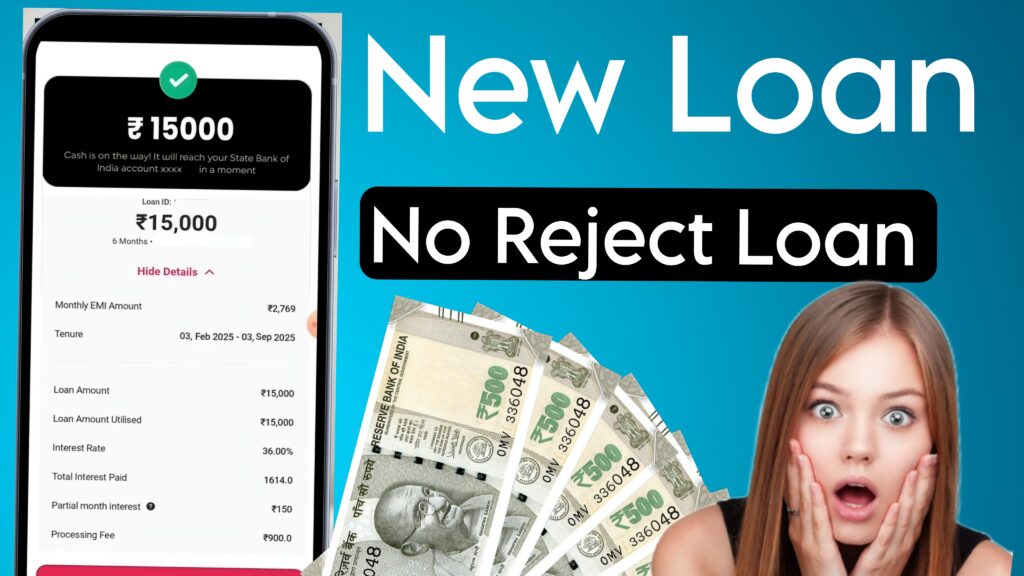

urgent Cash Loan के बारे में जाने

Why Niro is Different?

Market mein kai loan apps hain, but Niro ka unique combination of transparency, trusted partners, aur user-friendly experience ise alag banata hai. Aapko na zyada paperwork ka jhanjhat, na hi long waiting periods. Bas app kholo, apply karo, aur apke sapne sach karo!

Final Words

Niro Loan App ek aisa platform hai jo apki financial needs ko samajhta hai aur unhe instantly fulfill karta hai. Chaho ghar ke liye furniture, medical expenses, ya phir ek dream vacation, Niro ke saath paise ki tension khatam! Download karo aaj hi aur dekho kitna asaan hai loan lena.

Disclaimer: Niro koi NBFC ya bank nahi hai. Yeh loans trusted lending partners ke through provide karta hai. Interest rates aur fees aapke credit profile pe depend karte hain.

Toh der kis baat ki? Niro Loan App download karo aur apni financial journey ko banao super smooth! 🚀

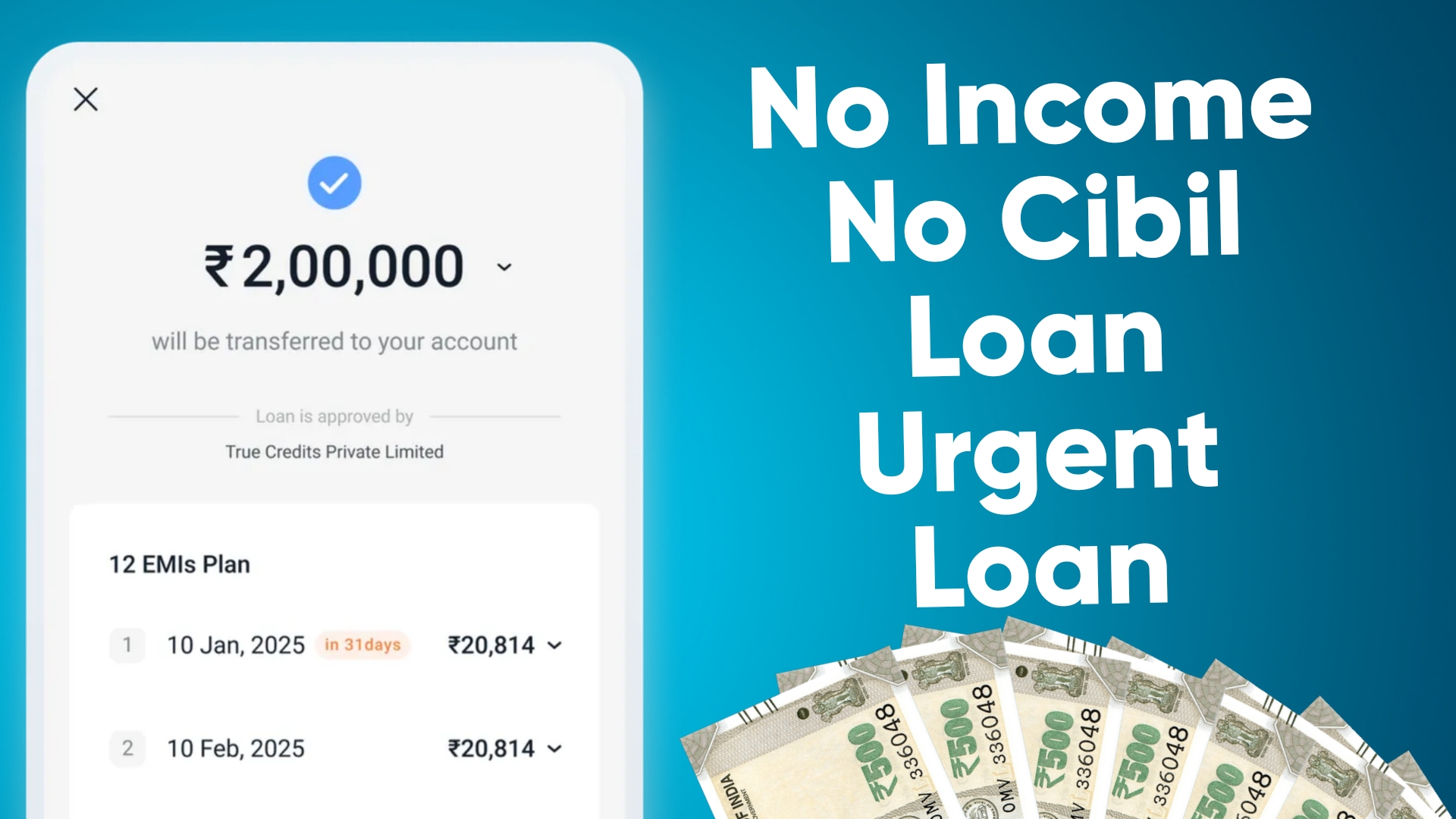

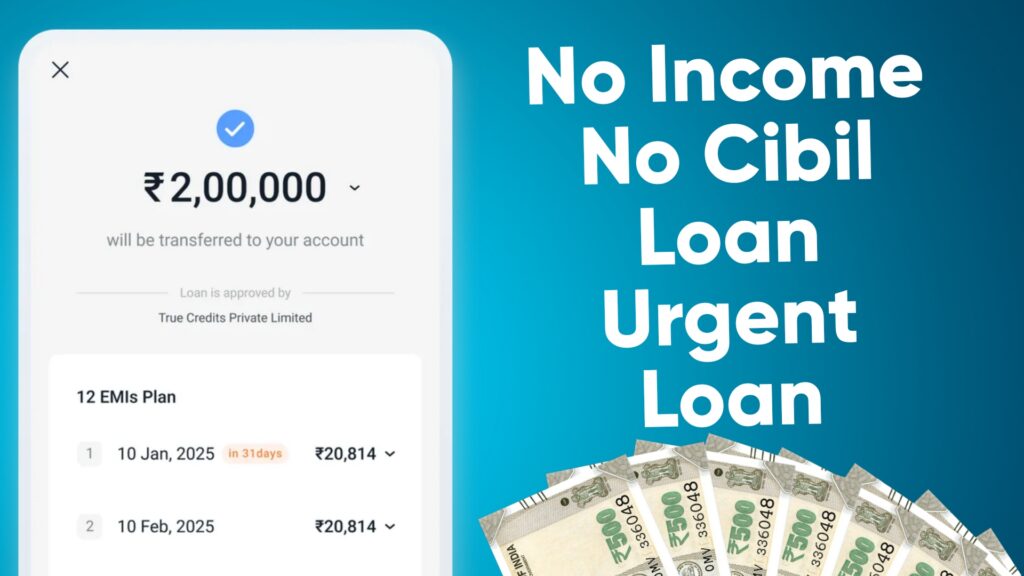

2,00,000₹ Urgent Cash Loan With 100% Approval