3 New Loan App 2025 Fast Approval : Best Instant Loan

Picture this: it’s 2025, and life’s throwing curveballs. Maybe your car broke down, or you’re eyeing that dream vacation but your savings are playing hard to get. Whatever the pinch, you need cash fast, and the last thing you want is to drown in paperwork or explain your income (or lack thereof). Enter three freshly launched loan apps in 2025 that are shaking up the lending game by offering quick, hassle-free loans without demanding income proof. These apps are your new financial sidekicks, ready to swoop in with funds when you need them most. Let’s dive into what makes these apps stand out, and I’ll reveal their names at the end for a little suspense!

App #1: The Speedy Savior for Instant Needs

First up is an app that’s all about speed and simplicity. Imagine applying for a loan while sipping your morning coffee and having the money in your bank account before you finish the cup. This app offers personal loans ranging from ₹1,000 to ₹5 lakh, with approval times as quick as 10 minutes. What’s the catch? There isn’t one! You don’t need to submit income proof, making it a lifeline for freelancers, students, or anyone with irregular earnings. The app’s 100% digital process means no visits to stuffy bank branches or endless document uploads—just a few taps on your phone.

The interest rates? They’re competitive, starting at around 12% per annum and going up to 28.5%, depending on your credit profile. Repayment terms are flexible, stretching from 3 to 60 months, so you can tailor the loan to fit your budget. Plus, it’s backed by RBI-registered NBFCs, ensuring your data and transactions are safe. Whether it’s an emergency medical bill or a spontaneous shopping spree, this app has your back with transparency and zero hidden fees. Users rave about its user-friendly interface, though some mention occasional app glitches—nothing a quick email to their responsive support team can’t fix.

App #2: The All-in-One Financial Wizard

Next, we have an app that feels like a financial Swiss Army knife. Need a personal loan? A business loan? Maybe a two-wheeler loan? This one’s got it all, and it doesn’t care about your payslips either. With loan amounts from ₹6,000 to a whopping ₹10 lakh, it caters to both small emergencies and big dreams. The app’s standout feature is its seamless integration with multiple RBI-approved lenders, which means you get a variety of loan options tailored to your needs without the income proof hassle.

Interest rates here range from 12% to 28.5% per annum, and you can repay over 6 to 60 months. The app prides itself on a paperless process—just upload your KYC documents (like Aadhaar or PAN), and you’re good to go. It’s perfect for young professionals or self-employed folks who might not have traditional income documents but still need funds fast. The app also throws in some cool extras, like the option to buy or sell 24K gold digitally. A few users have noted that customer service can be slow during peak times, but the quick disbursal (often within minutes) more than makes up for it. If versatility and speed are what you’re after, this app’s a winner.

App #3: The Minimalist Money Solution

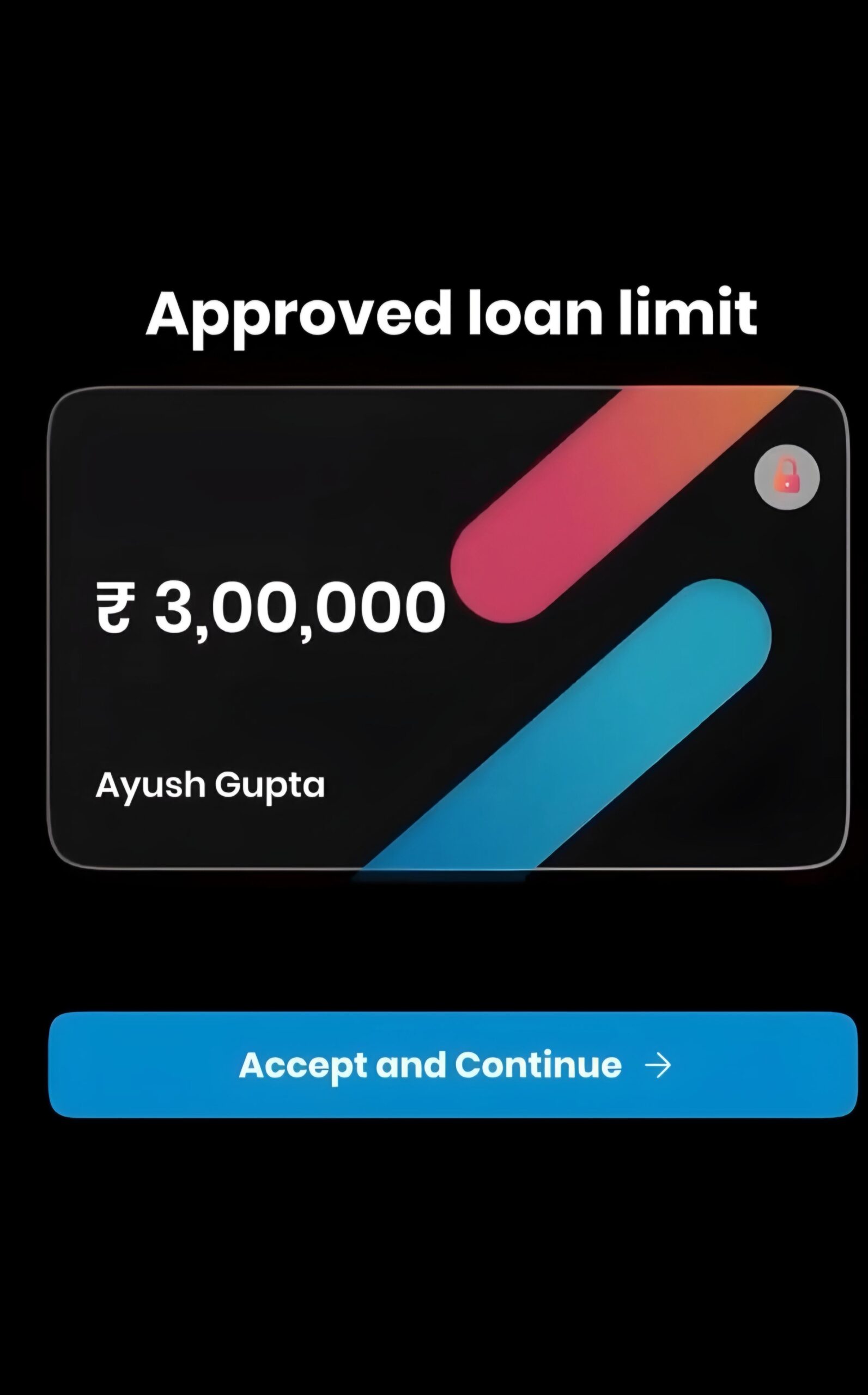

Last but not least is an app that keeps things refreshingly simple. Designed for those who want cash without the fuss, it offers loans up to ₹8 lakh with a focus on minimal documentation. No income proof? No problem. This app uses alternative credit scoring models, looking at things like your transaction history or digital footprint to gauge eligibility. It’s a godsend for gig workers, students, or anyone whose income doesn’t fit neatly into a bank’s checklist.

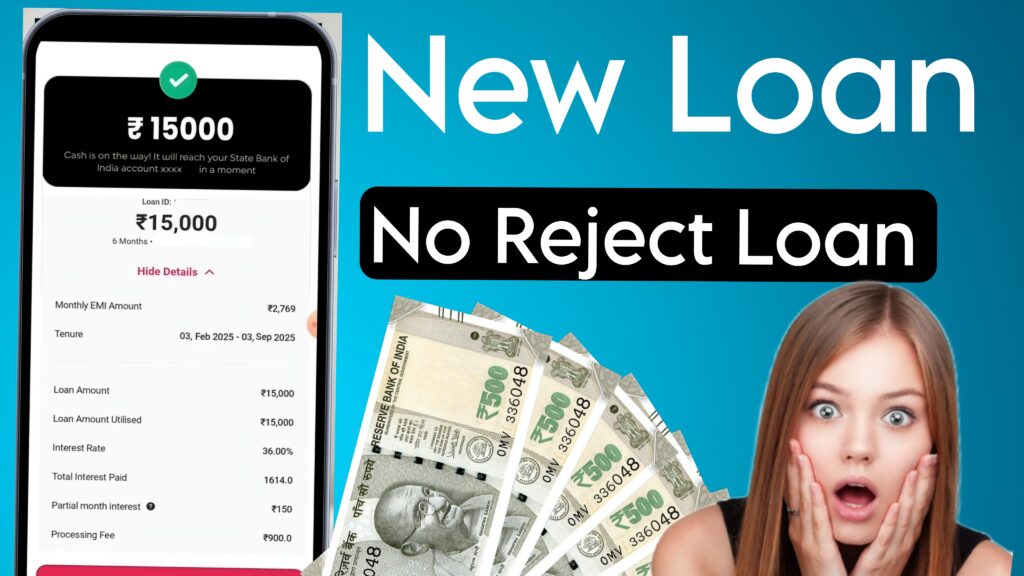

The interest rates are slightly higher, starting at 16% and capping at 36% per annum, reflecting the risk of lending without income proof. Repayment tenures range from 3 to 36 months, giving you enough breathing room to pay back comfortably. The app’s sleek design and intuitive navigation make borrowing feel less like a chore and more like ordering food online. It’s partnered with RBI-regulated NBFCs, so you can trust it’s legit. Some users have mentioned that loan limits start small for new borrowers, but timely repayments can unlock higher amounts. For those who value simplicity and speed, this app is a breath of fresh air.

Why These Apps Are a Big Deal in 2025

What ties these three apps together is their mission to make borrowing accessible to everyone, not just those with fat paychecks or perfect credit scores. By skipping income proof, they’re opening doors for millions—students, freelancers, gig workers, and even salaried folks who don’t want to dig through old payslips. In a world where financial needs are as diverse as we are, these apps are rewriting the rules of lending. They’re fast, transparent, and backed by RBI-regulated partners, so you can borrow with peace of mind.

But a word of caution: while these apps make borrowing easy, it’s still debt. Always read the fine print, check the interest rates, and borrow only what you can repay. A quick loan can be a lifesaver, but reckless borrowing can turn into a headache.

The Big Reveal: Meet Your New Financial Friends

Ready for the names? Drumroll, please! The first app, the speedy savior, is KreditBee. The all-in-one financial wizard is InCred Finance. And the minimalist money solution is Ring Loan App. These three are leading the charge in 2025, making instant loans without income proof a reality for millions of Indians.

So, whether you’re in a pinch or planning something big, download one of these apps today and take control of your finances. Got a favorite? Or another app you’re curious about? Let me know, and I’ll dig into it for you