Pawram Flex Loan App Real or Fake?Pawram Flex Loan App Review 2025:

The Pawram Loan Flex app, marketed as a “secure and intelligent mobile lending platform,” has gained attention in India for its promise of instant personal loans through a fully digital, paperless process. Developed by Pawram Trading Private Limited, the app claims to partner with Udvai Traders Private Limited, an RBI-registered Non-Banking Financial Company (NBFC), to provide compliant and transparent loan services. However, user reviews and complaints paint a troubling picture, raising serious questions about the app’s legitimacy, transparency, and ethical practices. This article dives deep into the app’s description, user feedback, and broader concerns about digital lending to determine whether Pawram Loan Flex is a trustworthy platform or a potential scam.

Overview of Pawram Loan Flex App

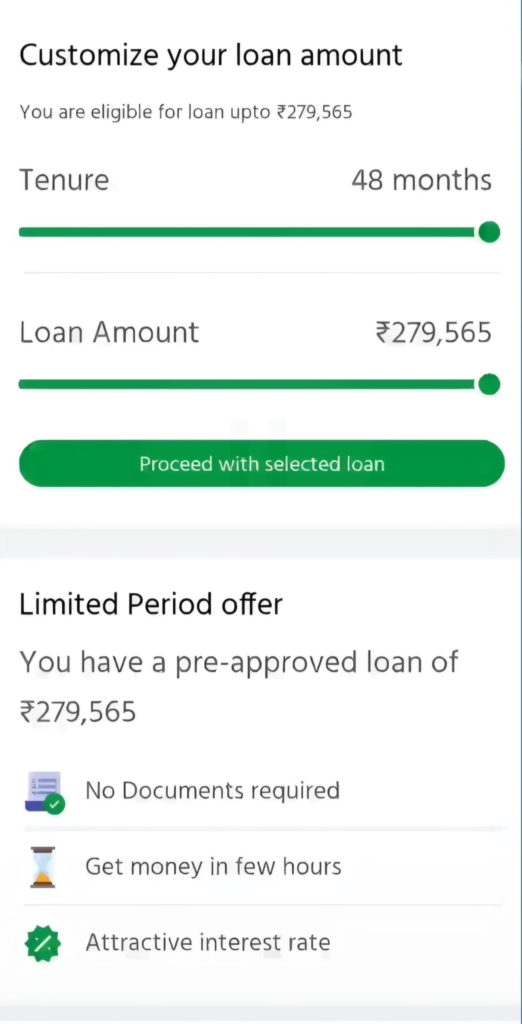

According to its official description on Google Play, Pawram Loan Flex is designed to advance financial inclusion through digital innovation. The app offers short-term personal loans ranging from ₹2,000 to ₹100,000, with loan tenures of 90 to 120 days. It emphasizes a seamless, user-friendly experience with features like:

- Fast & Flexible Processing: Loan applications are evaluated within minutes using real-time credit checks.

- Secure Disbursement: Funds are transferred directly to verified bank accounts.

- Customizable Loan Options: Users can choose loan amounts based on their needs.

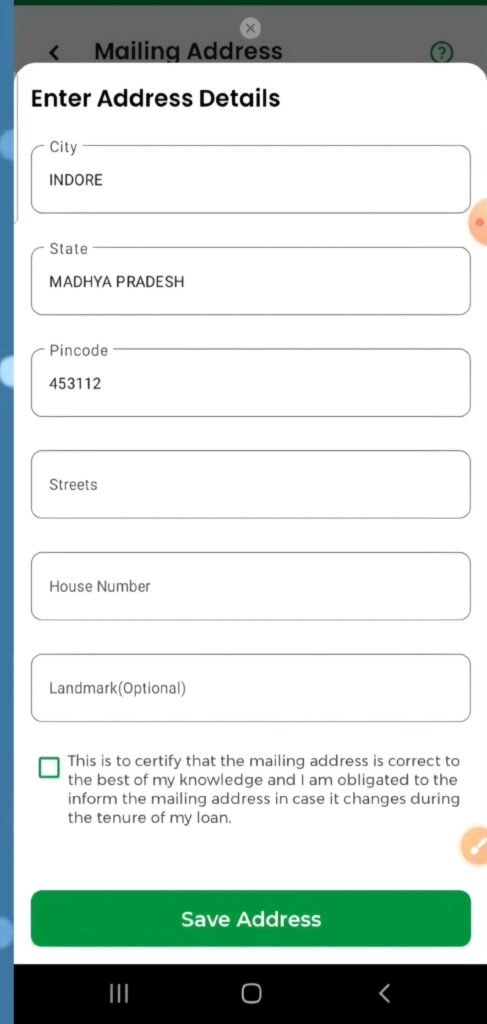

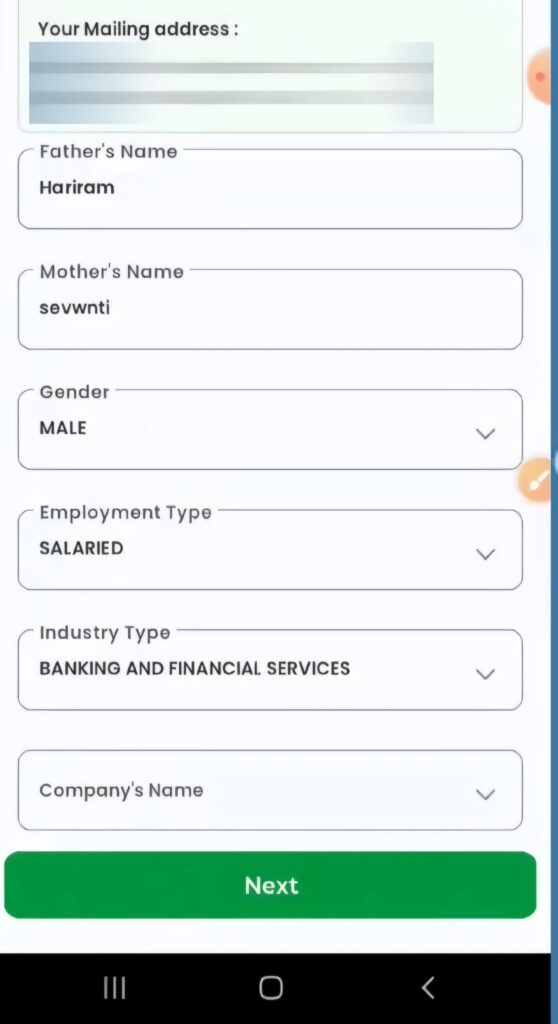

- Fully Digital Process: No physical documentation or in-person visits are required.

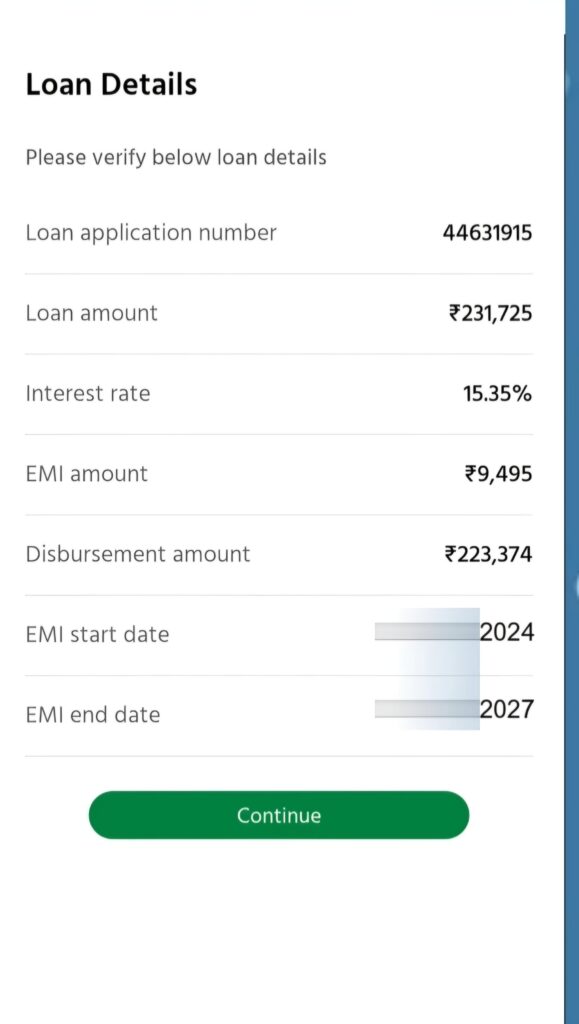

The app is operated by Pawram Trading Private Limited, which acts as a technology facilitator, while loans are disbursed by Udvai Traders Private Limited, an RBI-registered NBFC. The app highlights regulatory compliance, transparency in loan terms, and secure handling of user data. For example, a ₹30,000 loan for 90 days incurs:

- Interest: ₹1,350 (0.05% daily rate)

- Processing Fee: ₹1,500 (5%)

- Documentation Fee: ₹300 (1%)

- Convenience Fee: ₹200

- GST (18% on fees): ₹360

- Total Deductions: ₹2,360

- Net Disbursed Amount: ₹27,640

- Total Repayable Amount: ₹33,710

On paper, these terms seem reasonable for a short-term loan, and the partnership with an RBI-registered NBFC lends credibility. However, user reviews and complaints reveal significant discrepancies between the app’s promises and its actual practices.

User Reviews: A Pattern of Complaints

User feedback on platforms like Google Play and Reddit reveals a consistent pattern of negative experiences with Pawram Loan Flex. Below is a detailed analysis of the most common complaints, supported by specific user reviews:

1. Unauthorized Loan Disbursements

One of the most alarming issues is the app’s tendency to disburse loans without user consent. For instance, Mohd Zaid (23/07/2025) reported, “It is the worst app for loan purpose, transferred money automatically into my account without me accepting the offer. It is a scam and fraud. Rate is too high for the loan of ₹3,000, about half of the amount was deducted.” Similarly, Devranjan Singh (25/07/2025) stated, “Sent me loan amount without any loan sanction letter, without my consent and showed ₹3,000 but the loan amount was ₹1,800 out of which only ₹1,000 came and repay amount is ₹3,000 for 7 days only.”

These reviews suggest that the app may automatically credit small loan amounts to users’ accounts, even if they haven’t formally accepted the loan offer. This practice is not only unethical but also potentially illegal, as it violates the principle of informed consent in financial transactions.

2. High Fees and Hidden Charges

While the app’s description outlines fees like processing (5–6%), documentation (1%), and convenience fees, users report that the actual deductions are disproportionately high. For example, in the case of a ₹3,000 loan, users like Devranjan Singh noted that only ₹1,000 was credited after deductions, yet the repayment amount remained ₹3,000 for just seven days. This translates to an effective interest rate far exceeding the stated 0.05% daily rate (equivalent to an APR of 8.76–29.69%). Such practices align with predatory lending tactics, where exorbitant fees and interest rates trap borrowers in a cycle of debt.

3. Data Privacy and Harassment Concerns

Several users have raised serious concerns about data privacy and harassment. Minarul Haque (26/07/2025) reported, “Problem is that when I tried to delete my account & bank details, their deletion page is not working. Very bad experience…. If you don’t give loan, then why are you holding my details?” Another user (23/07/2025) alleged, “This app is blackmailing users by accessing their contact list and sending edited nude photos to their family and friends. They are asking for money and threatening to leak private images.”

Parvez Syed (19/07/2025) added, “I have just filled my details in app and they are threatening from WhatsApp to repay the loan, I have not availed any loan from this app still getting messages.” These complaints suggest that the app may misuse personal data, such as contact lists and identity documents, to harass users or extort money. Such actions are not only unethical but also violate India’s data protection laws and RBI guidelines on fair lending practices.

4. Poor Customer Support

Multiple users have reported a lack of responsive customer support. Saddam Lucky (26/07/2025) stated, “No any customer support or contact number,” while another user on Reddit (u/IdeaInternational598, 21/06/2025) noted, “There is no support option and the phone number provided is switched off.” The absence of accessible customer service is a red flag, as legitimate lending platforms typically offer robust support to address user concerns.

5. Technical Issues and Misleading Practices

Users have also reported technical glitches and misleading practices. For instance, a Reddit user described a case where a friend was shown as eligible for a ₹1,000 loan, which appeared in their account with late fees despite not being accepted. The user added, “The payment links keep changing to vague UPI IDs daily and even that does not work.” Such issues indicate a lack of transparency and reliability in the app’s operations.

Is Pawram Loan Flex RBI-Compliant?

The app’s description emphasizes its partnership with Udvai Traders Private Limited, an RBI-registered NBFC, which should theoretically ensure compliance with RBI guidelines. The RBI mandates that digital lending platforms adhere to fair practices, including:

- Providing clear loan agreements before disbursement.

- Ensuring transparency in fees and interest rates.

- Protecting user data and preventing misuse.

- Offering accessible grievance redressal mechanisms.

However, user complaints about unauthorized disbursements, lack of loan agreements, and data misuse suggest that Pawram Loan Flex may not fully comply with these standards. While the app’s NBFC partnership lends some legitimacy, the reported practices align more closely with those of fraudulent loan apps flagged by the RBI. In 2025, the RBI has cracked down on illegal lending apps, removing several from Google Play for violating guidelines. Although Pawram Loan Flex is not explicitly listed in RBI’s banned apps, the absence of its NBFC partner’s name in some user complaints raises doubts about the transparency of this partnership.

Comparing Pawram Loan Flex to Legitimate Loan Apps

To assess Pawram Loan Flex’s legitimacy, it’s useful to compare it to RBI-approved loan apps like KreditBee, MoneyView, and Kissht, which are known for their transparency and compliance. These apps typically:

- Provide clear loan agreements before disbursing funds.

- Deduct fees from the loan amount rather than requiring upfront payments.

- Offer responsive customer support through multiple channels.

- Maintain strict data privacy standards.

In contrast, Pawram Loan Flex’s reported practices—such as unauthorized disbursements, inaccessible customer support, and data misuse—mirror the characteristics of fake loan apps outlined by platforms like LoanTap and Fibe. These sources warn that fraudulent apps often lure users with promises of instant loans, only to engage in data theft, harassment, or exorbitant charges.

Red Flags of a Potential Scam

Based on user reviews and industry standards, several red flags suggest that Pawram Loan Flex may be a scam or, at the very least, an unreliable platform:

- Unauthorized Loan Credits: Disbursing loans without consent violates RBI guidelines and is a common tactic used by scam apps to trap users in debt.

- Data Privacy Violations: Allegations of blackmail and misuse of contact lists indicate serious breaches of data protection laws.

- High Fees and Short Repayment Periods: Deducting nearly half the loan amount as fees and requiring repayment within seven days is predatory and unsustainable for most borrowers.

- Lack of Customer Support: The absence of responsive support channels prevents users from resolving issues or deleting their data.

- Technical Glitches: Non-functional account deletion pages and unreliable payment links undermine the app’s credibility.

Advice for Consumers

Given the serious concerns raised by users, here are steps to protect yourself if considering Pawram Loan Flex or similar apps:

- Verify RBI Registration: Check the RBI’s official website to confirm that the NBFC (in this case, Udvai Traders Private Limited) is registered and reputable.

- Read User Reviews: Platforms like Google Play and Reddit provide valuable insights into an app’s reliability. Look for patterns in complaints, such as those about Pawram Loan Flex.

- Demand Transparency: Ensure the app provides a clear loan agreement detailing all terms before funds are disbursed. Avoid apps that demand upfront fees.

- Protect Your Data: Be cautious about sharing sensitive information like PAN, Aadhaar, or bank details. If an app misuses your data, report it to the cybercrime portal (cybercrime.gov.in).

- Report Suspicious Apps: If you encounter fraudulent practices, report the app to Google Play, Apple App Store, or the RBI’s Sachet portal.

Conclusion: Proceed with Extreme Caution

While Pawram Loan Flex presents itself as a legitimate lending platform with an RBI-registered NBFC partner, user reviews and complaints tell a different story. Allegations of unauthorized loan disbursements, data misuse, harassment, and poor customer support raise serious doubts about its trustworthiness. These practices align closely with those of fraudulent loan apps, which exploit vulnerable borrowers with high fees and unethical tactics.

Until Pawram Loan Flex addresses these concerns and demonstrates consistent compliance with RBI guidelines, it’s advisable to avoid this app. Instead, opt for well-established, RBI-approved loan apps like KreditBee, MoneyView, or Kissht, which have better track records for transparency and customer satisfaction. If you’ve already used Pawram Loan Flex and faced issues, report them to the RBI, cybercrime authorities, or the app store to protect yourself and others from potential scams.