Small Rupee loan App Review :Small Rupee loan Real or Fake?

Small Rupee loan app Review : If You want to take loan from small Rupee loan app then You Should know about This loan app Features and Hidden Truth Which I will tell You on this Post. Small Rupee loan app is Fake type of Loan app Because of many reasons like it Gives only 7 day loan tenure, Charges very Rates of interest & collect Customer Data So Don’t Apply on this instant loan app

Small Rupee loan app : Basic Features

- Small Rupee Loan App has more than 100K+ Download

- It Has 4.3 star rating with 3k Review & Majority of review is paid

- Small Rupee loan amount from 2000 to 30,000₹

- Small Rupee loan app tenure from 100 Day to 365 day according to Play Store Ratings but in Reality they Give only 7 day loan

- Small player loan app NBFC partner : primary partner NBFCs – Small Investment Private Limited is a Systemically Important NBFC within the group companies carrying the brand.

- Small Rupee app Interest rates 14% which is totally wrong information publish in about section they charge more than 50% of loan amount

Small Rupee instant Loan App eligibility criteria

- Applicant must be indian Citizen

- Applicants age more than 20 years

- Applicants Should Have Valid Aadhar card for address Verification

- applicants Should have Pan Card

- Monthly Source of income only for formalities no check

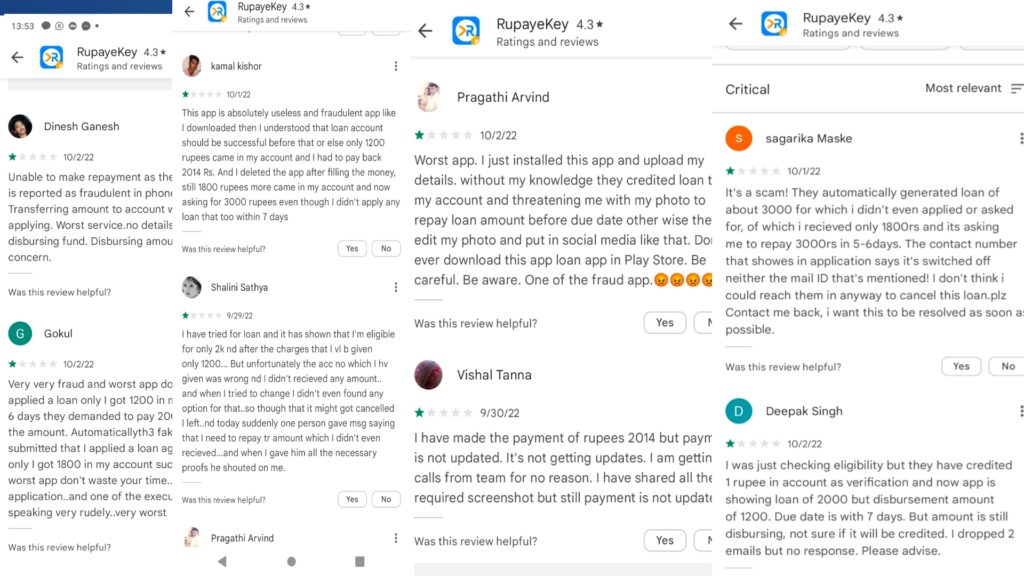

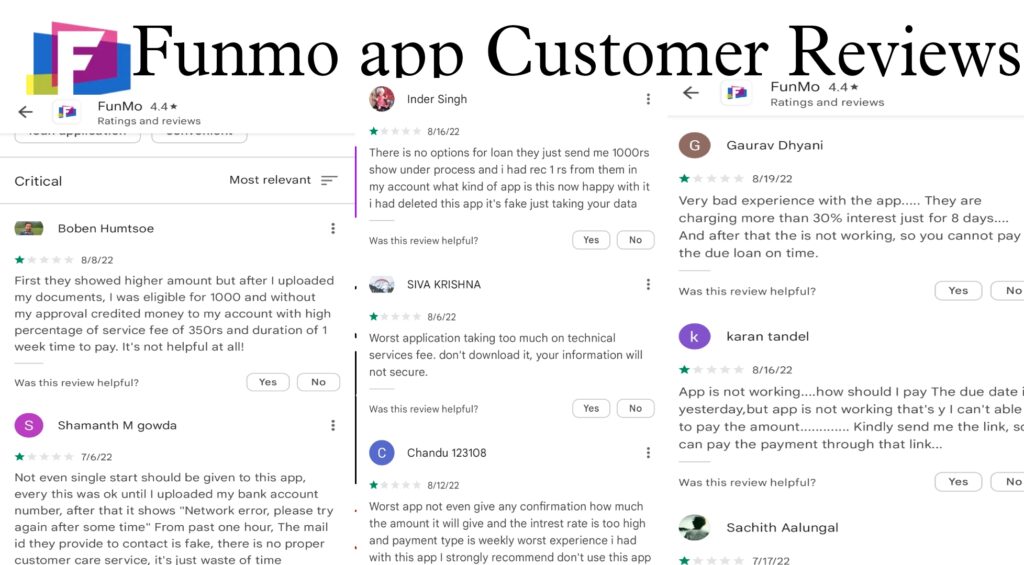

Small Rupee loan Customer Reviews

- If You See this Critical Review which is Given by Their Customer then it is clear that it is 7 day loan app

- Most cases they want only customer data & there is no intention of lending loans or Distributing loans

- They are Very short term loan which is unauthorised and don’t follow Google Play Store policies

- Don’t Repay loan of Such type of 7 day loan app because they Are Fraudsters and looters

- Click Here For taking personal loans from RBI approved loan app