ICICI Bank loan Process : ICICI Bank loan Review

icici bank loan process :- If You want to take loan from ICICI Bank the You Should Read this Full details icici bank loan review . Icici bank one the most trusted private bank of india it has million User in india and around the world if you need urgent money for emergency , personal loan EMI , medical emergency or any due settlement you can take loan from ICICI Bank with Very Simple Process

Icici bank loan Eligibility kya hai ?

- Over 23 year and Indian resident

- Salaried individuals,having a regular monthly income 30,000+

- Having A Good Credit score if your credit score is excellent Your approval rate is very High if Your Credit score low then Your approval rate low

- Having a saving Account in any bank of india ( If You have icici bank account then you get pre approved loan offers)

- Aadhar card and pan card needed

Icici bank loan review : loan amounts, interest rates , charges

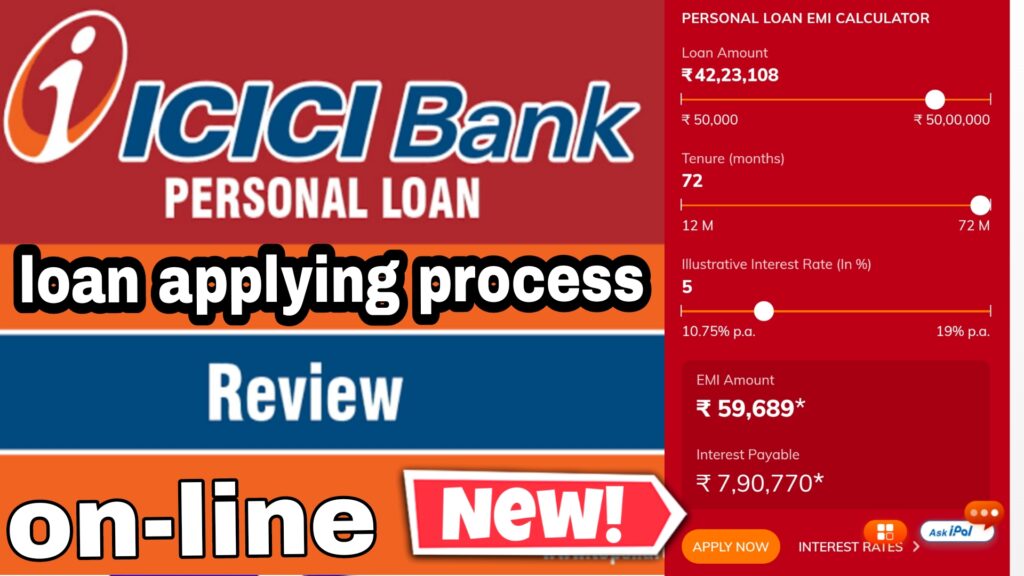

- icici bank loan amount from 50,000 Rupee to 50 lakh which is good for needy people

- Icici bank loan tenure from 12 months to 60 month’s which is good

- Icici bank loan interest rates 10.90% to 19% per annum which is good for salaried employee

- Icici bank loan processing fees 2.5% of loan amount + GST

- icici bank bouncing charge 400 per bounce+ GST

- loan cancellation charges 3000 + GST

- additional interest on late payment is 24% per annum

How to Apply icici bank loan : icici loan process

- You Can Apply ICICI personal loan by Directly icici bank loan app or Website

- First you have to check eligibility by Giving some। Details about you

- After checking you get loan offer from the icici bank after that You can customize loan offer according to your need

- Then Sanctioned letter ✉️ is provided by bank after that money disburse on your given bank account