Vizzvi loan app Review,Vizzvi instant loan app : Real or Fake

Vizzvi loan app review :- If You need emergency funds and you want take loan for full fill need then you can take loan from vizzvi instant loan app if you are salaried or Students. Vizzvi loan has 1 lakh plus users in playstore and today I will Give You Complete Review on Vizzvi instant personal loan.Should I take loan from vizzvi loan app & what is interest rates, processing fees and hidden charges of Vizzvi loan app

Get Vizzvi loan instantly : Click here

Vizzvi loan app : Basic Features

- Vizzvi instant loan give you loan amount from 500 to 100,000₹

- vizzvi loan app tenure from 3months to 6 months

- Vizzvi loan app interest rates 0.07% daily ( 25.55%per annum)

- Processing fees ranges from 90₹ to 2000₹ for one time charge which depends upon loan amount and loan details

- GST :- 18% on processing fees in accordance with the policy and law of india

- Vizzvi loan app has 100k+ download with 4.7 star rating and 3000 Reviews

Documents Required for Vizzvi instant loan

- Aadhar card

- Identity proofs ( driving licence / votar id /passport/aadhar card /pan card)

- address Proof ( same as identity proof)

- original passport / selfie

- You can get personal loan on Aadhar card & Esign Your application with registered mobile otp for fast approval

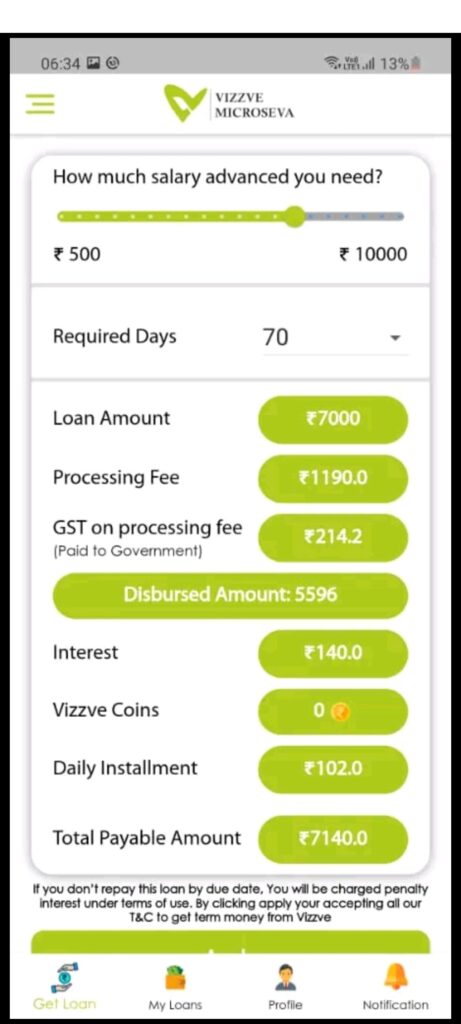

A Representative Example of the Cost of loan

You Can See Vizzvi instant loan app Repayment Example and CHARGES & No Hidden Charges apply on this but this loan only for Salaried and Student If You self employed then You can’t take loan from vizzvi loan app and Read Term and conditions carefully of this loan app

Vizzvi loan app Customer reviews

IS Vizzvi loan app NBFC registered : Vizzvi loan RBI approved or not?

The loan are provided by vizzvi microseva foundation providing financial services Which is registered not deposit taking Systemically non banking company and approved by RBI.you can avail personal loan and Home loan from this loan app