PawramLoanFlex Scam Exposed: 7 Day Loan App Ke Naam Par Heavy Charges Aur Fraud – Kyun Na Download Karein!

Aaj kal paise ki zarurat sabko hoti hai, aur instant loan apps jaise PawramLoanFlex jaise apps logon ko attract karte hain. Lekin kya ye app sach mein helpful hai ya sirf ek bada scam? Is article mein hum detail se baat karenge PawramLoanFlex ke bare mein, jisme hum focus karenge uske critical reviews par jo Play Store par mile hain. Ye app 7 day loan deta hai lekin bahut heavy charges lagata hai, aur users ke reviews se lagta hai ki ye fraud hai. Hum app ke description par zyada bharosa nahi karenge, balki real user experiences par. Agar aap soch rahe hain download karne ke bare mein, to pehle ye padh lijiye – shocking sachai aapko hairan kar degi!

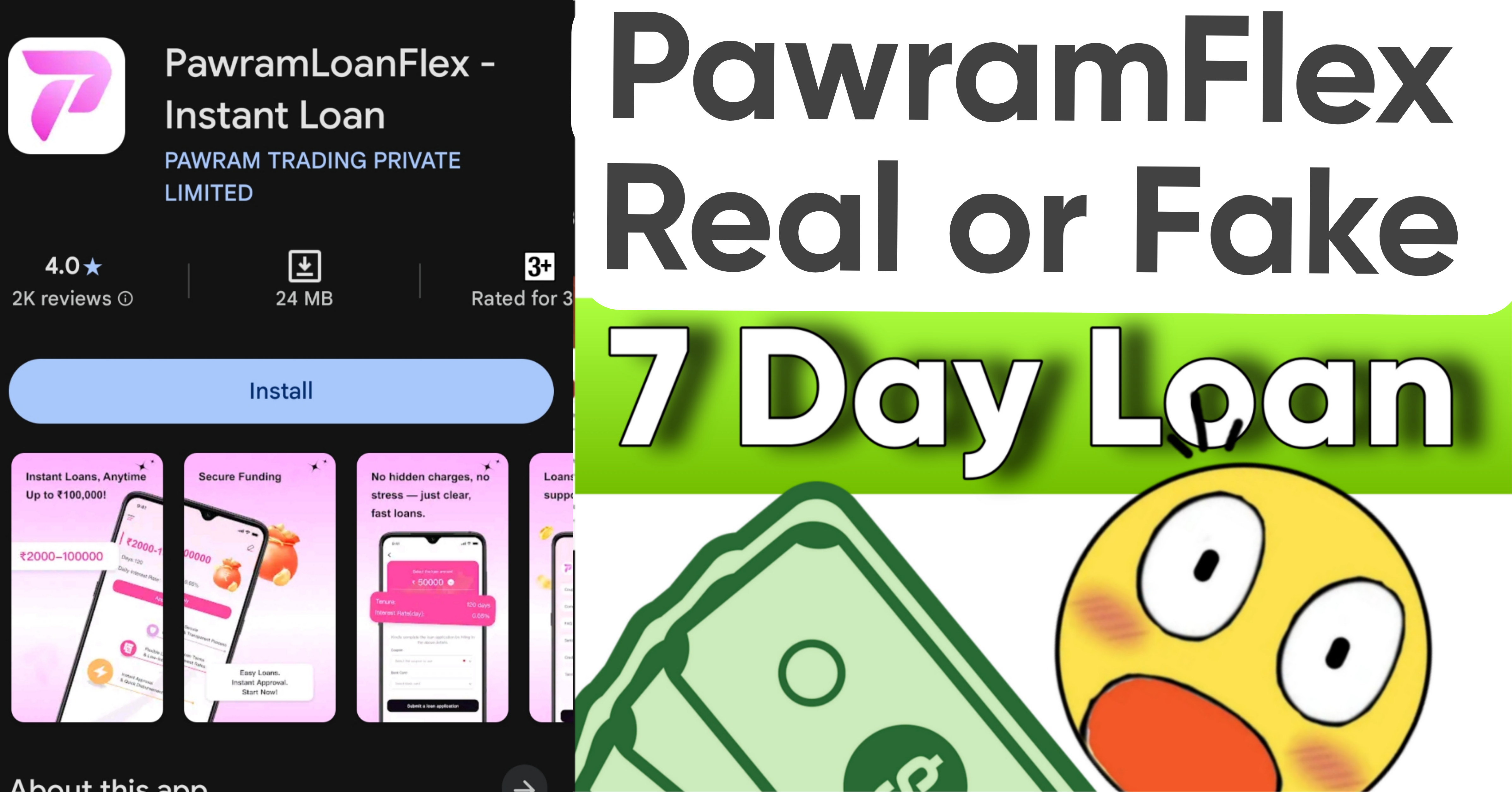

PawramLoanFlex ek instant loan app hai jo Google Play Store par available hai, ID com.pawramloanflex.pawramtrading ke saath. Ye Pawram Trading Private Limited dwara banaya gaya hai. App ke according, ye quick loans provide karta hai bina zyada paperwork ke, lekin reviews batate hain ki ye sab jhooth hai. Current date December 23, 2025 hai, aur app ka rating 4.2 stars dikh raha hai screenshots mein, lekin critical reviews mein 1-star ratings bhare pade hain. Downloads 1M+ se zyada hain, lekin ye number misleading ho sakta hai kyunki bahut se users scam ka shikar ho chuke hain.

PawramLoanFlex App Kya Hai Aur Kaise Kaam Karta Hai?

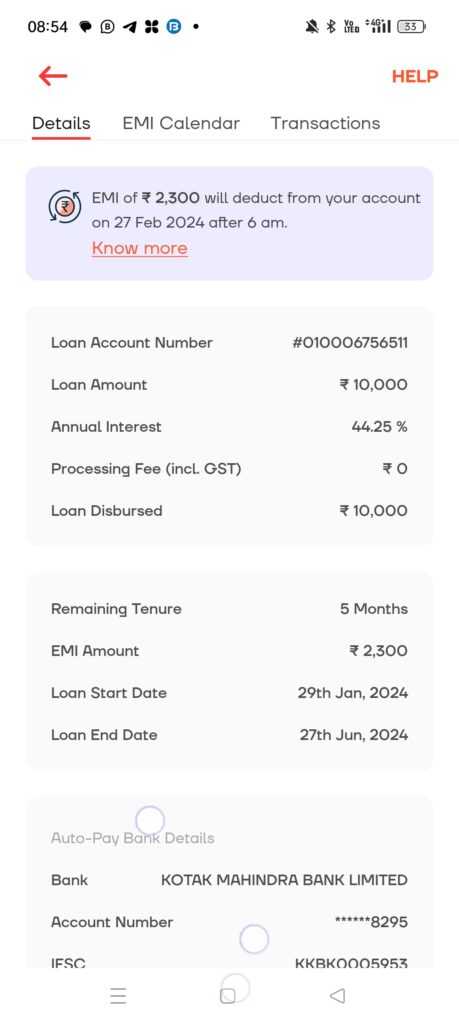

PawramLoanFlex ko promote kiya jata hai jaise ek flexible instant loan app jo aapko turant paise de sakta hai. App ke description mein kahaa jata hai ki ye safe hai, quick approval deta hai, aur low interest rates hain. Lekin yahan pe hum doubt karte hain – kyunki real users kehte hain ki ye 7 day loan deta hai lekin interest aur charges itne high hote hain ki repay karna mushkil ho jata hai. For example, agar aap 10,000 rupees lete ho, to 7 din mein hi 20-30% charges add ho sakte hain, jo illegal level ke hote hain RBI guidelines ke against.

App download karne ke baad, aapko PAN, Aadhaar, bank details submit karne padte hain. Phir app credit score check karta hai aur loan approve karta hai. Lekin problem yahan se shuru hoti hai – bahut se users kehte hain ki app automatically loan credit kar deta hai bina user ke approval ke, aur phir repay maangta hai high charges ke saath. Support number jaise 9646293298 dial karo to wo fraud show karta hai caller ID par, aur koi response nahi milta.

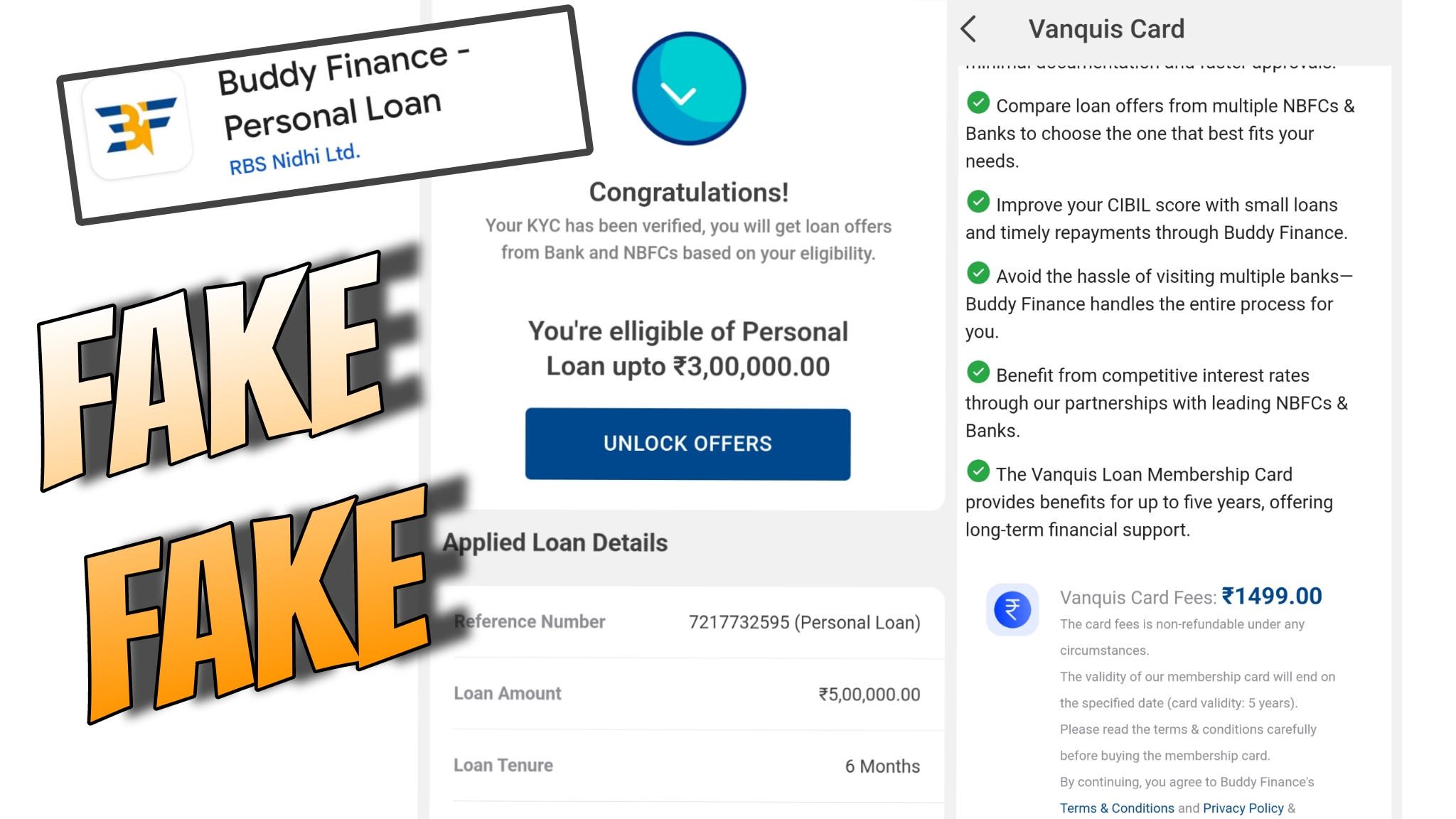

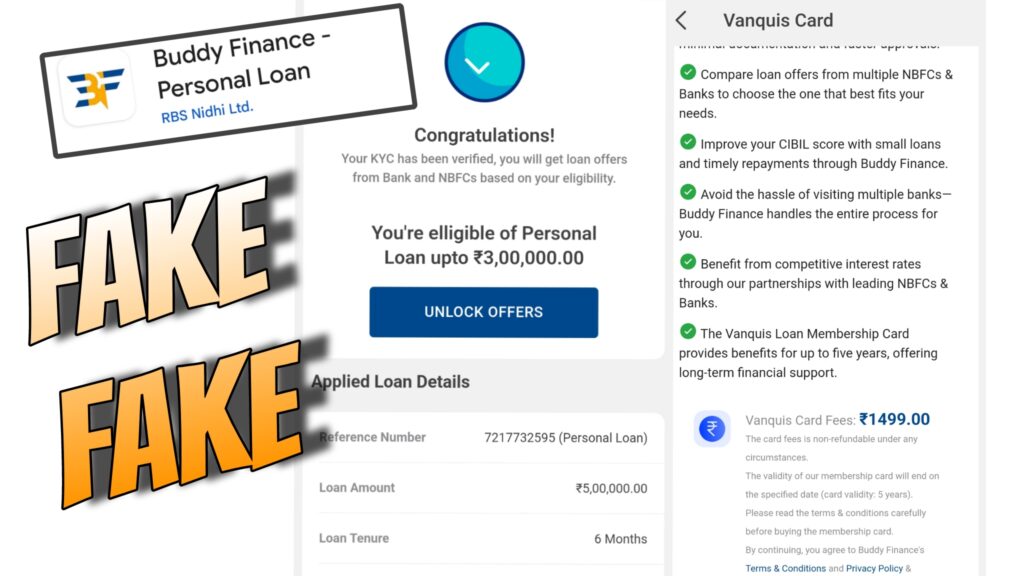

Humne Play Store se reviews dekhe (link: https://play.google.com/store/apps/details?id=com.pawramloanflex.pawramtrading), aur images se bhi confirm kiya. Zyadatar critical reviews mein log bol rahe hain ki paise credit show hota hai app mein, lekin bank account mein nahi aata. Phir bhi repay karne ke calls aate hain, aur na karo to credit score kharab kar dete hain. Ye ek typical loan app scam lagta hai jo India mein bahut common hai, jaise Chinese loan apps ke jaise.

Critical Reviews: Real Users Ki Kahaniyan Hinglish Mein

Ab hum add karte hain wo reviews jo images mein diye gaye hain aur Play Store se similar. Inko Hinglish mein likha hai taaki Indian audience easily samajh sake. Ye sab 1-star reviews hain, aur logon ne inko helpful maana hai.

- Hemjyoti Barman ka Review (24/09/25): “Main already sab documents bhej chuka hoon – PDF, screenshot, aur dusri information email se, lekin ab tak koi response ya resolution nahi mila. Reply na milna, aur customer support number fraud show kar raha hai caller pe, ye experience bahut frustrating aur concerning hai. Please genuine support do aur mera issue jaldi solve karo.” (161 logon ne ise helpful maana). Company ka reply: “Dear customer, hum sorry hain inconvenience ke liye. Please hamare hotline 9646293298 par contact karo.”

- Melvin M ka Review (21/11/25): “Bhai log, ye pure scam app hai, kitna bhi desperate ho paise ke liye, is app se mat lo warna pit jaoge. Ye automatically amount credit kar dete hain bina accept kiye, high charges ke saath. Unke phone numbers check karo to koi work nahi karta. App mein credit score tap karo to har baar change ho jata hai. Agar bina approval ke credit karein to repay mat karna galti se, wo deny kar denge ki tumne pay kiya.” (302 logon ne helpful maana).

- Sachin Bagali ka Review (10/10/25): “App mein money credited show ho raha hai, lekin maine receive nahi kiya. Helpline number bhi work nahi kar raha. Tum problem solve nahi karoge to main ye amount pay nahi karunga, complaint raise karunga. 10/10/2025 scenario abhi tak amount nahi mila, lekin tum repay maang rahe ho kal se. Bahut worst hai, main loan repay nahi kar sakta. Already app se request raise kiya, lekin tumhari taraf se no response. Support number nahi work kar raha, ye app fraud hai so please mat use karo.” (Helpful count nahi dikh raha, lekin similar reviews mein high hai). Company reply: “Sorry for inconvenience, agar loan nahi mila to bank statement provide karo.”

- Hari Krishnan ka Review (14/12/25): “App shows money credited, lekin maine paise receive nahi kiye. Helpline number bhi nahi chal raha. Problem solve nahi karoge to main pay nahi karunga, complaint dalunga. 18/09/2025 scenario abhi tak amount nahi aaya, lekin repay maang rahe ho kal. Very worst, main loan repay nahi kar sakta. Already request daala app mein, lekin no response from your side. Support number nahi work kar raha, ye app fraud hai plz dont use.”

- Anonymous Review (10/12/25): “The app shows money credited, but i didn’t receive money, i also the helpline number is also not working, i you didn’t solve the problem, I’m not going to pay this amount, will raise the complaint, 11/2025 Scenario Stil, didn’t received amount, but you are asking repay on tomorrow. It’s very worst, i can’t repay the loan. Already, raised the request via app, but there is no response from your side. Also, Support number is not working and very worst this app was froud so plz dont use this app.” (7 logon ne helpful maana). Company reply: “Apologize for inconvenience. If not received loan, provide bank statements.”

- Another Anonymous (24/09/25): Similar to Hemjyoti, documents bheje lekin no response, fraud support.

In reviews se clear hai ki app fraud hai. Log bol rahe hain ki paise nahi milte, lekin repay maangte hain. High charges, auto credit, credit score manipulate – ye sab signs hain ek bade scam ke. Play Store par aur bhi aise reviews hain, jahan log warn kar rahe hain ki mat download karo.

Risks Aur Warnings: Kyun PawramLoanFlex Se Door Rahen?

PawramLoanFlex jaise apps ke saath bahut risks hain. Pehla, ye 7 day loan hai jo short term hota hai, lekin interest rates 100-200% annualize ho sakte hain, jo RBI ke rules break karte hain. Dusra, data privacy – aapke PAN, Aadhaar, bank details leak ho sakte hain, aur hackers use kar sakte hain. Teesra, harassment – agar repay na karo to calls aate hain family ko, jo illegal hai.

India mein loan apps ke scams bahut badh gaye hain post-COVID. Government ne kai apps ban kiye hain jaise Chinese ones, lekin ye Indian company lagti hai lekin behavior same hai. Agar aap victim ho, to RBI ya police complaint karo. Cyber crime portal par report karo.

General advice: Kabhi bhi loan app se paise mat lo bina check kiye. Better options jaise banks, NBFCs use karo jo regulated hain. Credit score kharab na hone do – CIBIL check karo regularly.

Alternatives To PawramLoanFlex: Safe Loan Options

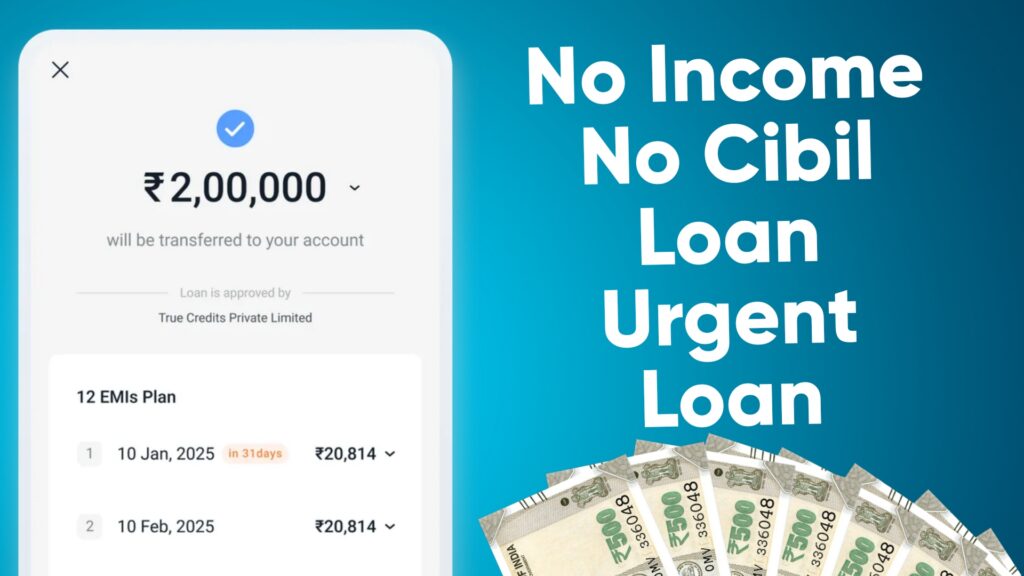

Agar aapko instant loan chahiye, to ye safe alternatives try karo:

- Paytm Personal Loan: Quick approval, low interest, trusted app.

- Bajaj Finserv: EMI options ke saath, no heavy charges.

- Bank Apps like SBI YONO: Government backed, safe.

- MoneyTap: Credit line jaise, flexible repay.

Inme se koi bhi use karo, reviews check karo pehle.

Conclusion: PawramLoanFlex – Scam Ya Nahi?

Overall, PawramLoanFlex ek scam app lagta hai based on critical reviews. Description mein jo promises hain wo jhooth hain – no genuine support, heavy charges, fraud activities. Agar aap download kar chuke ho, to uninstall karo aur data delete karo. New users, door raho! Ye article aapko warn karne ke liye hai taaki aap safe rahen.

FAQs About PawramLoanFlex Loan App

Q1: PawramLoanFlex safe hai kya?

A: Nahi, reviews se lagta hai ki ye scam hai. Heavy charges aur no support.

Q2: App mein loan kaise apply karen?

A: Mat apply karo, lekin agar karna hai to documents submit karo, lekin risk apna.

Q3: High charges kitne hote hain?

A: 7 days mein 20-30% ya zyada, jo bahut high hai.

Q4: Support number work karta hai?

A: Reviews kehte hain nahi, fraud show karta hai.

Q5: Agar paise nahi mile to kya karen?

A: Complaint raise karo RBI ya police mein, bank statement dikhao.

Q6: Alternatives kya hain?

A: Paytm, Bajaj, banks use karo.

Q7: Credit score kharab hota hai kya?

A: Haan, app manipulate karta hai reviews ke according.

Q8: Company real hai?

A: Pawram Trading Private Limited, lekin behavior fraudulent.

Q9: Download count kitna hai?

A: 1M+, lekin ye trust na karein.

Q10: Reviews fake hain kya?

A: Nahi, real users ke hain, helpful votes high hain.