Hero Fincorp Personal loan App Review : Hero Fincorp loan Review

Hero Fincorp Personal loan app Review : If You want to take personal loan from Hero Fincorp Personal loan app then You Should Read Full Review of Hero Fincorp loan app today I will Show you All hidden truth of Hero Fincorp loan app like Hidden Charges , Customer Reviews , interest rates , Processing fee, Documentation & Eligibility Criteria

- Is Hero Fincorp Personal loan app NBFC or not ?

- is Hero Fincorp loan app RBI approved?

- Is Hero Fincorp personal loan good or bad ?

Table of Contents

Hero Fincorp Personal Loan App : Hero Fincorp loan Basic Details

- Hero Fincorp Personal loan App NBFC : Hero Fincorp Finance Made Easy

- Hero Fincorp loan app more than 1 million downloads and 3.4 ratings

- Hero Fincorp Personal loan amount From 50,000₹ to 1,50,000₹ instantly in bank account

- Hero Fincorp loan Tenure : Minimum tenure 6 month and Maximum tenure 24 months

- Hero Fincorp loan interest Rates : Maximum interest rates 25 % per annum

- Processing Fees of Hero Fincorp personal :- 2.5% + Taxes applicable

How Hero Fincorp Personal loan Differ From other Personal loan?

- This Personal loan offered by on of the fastest growing financial services Companies :- Hero Fincorp

- Part of one of the most trusted business houses – Hero MotoCorp Group

- Instant personal loan anytime

- Completely digitized loan process

- Hassle-free KYC process that takes a few seconds to complete

- Quick response to customer queries

Type of Hero Fincorp loan: Loan type

- Hero Fincorp app gives personal loan

- You can be avail Cash loan and Small loan by SimplyCash Personal loan app

- Emergency loan

- Education loan

- Mobile loan , marriage loan ,Travel loan etc

Hero Fincorp loan Eligibility & Documents

- If you are Self employed then You Should have Decent Credit Score

- If you are salaried no need cibil score

- Applicants should Have Aadhar Card

- Pan Card for CIBIL Score

Personal loan Review video 👇

Key features of SimplyCash Personal loan app

- Easy sign-up, login & application process

- Hassle-free & Quick disbursal in few hours

- Get funds directly to your bank account

- No physical documentation

- Customise your loan amount & EMI

- Get personal loans up to ₹1,50,000

- Collateral free/unsecured loan

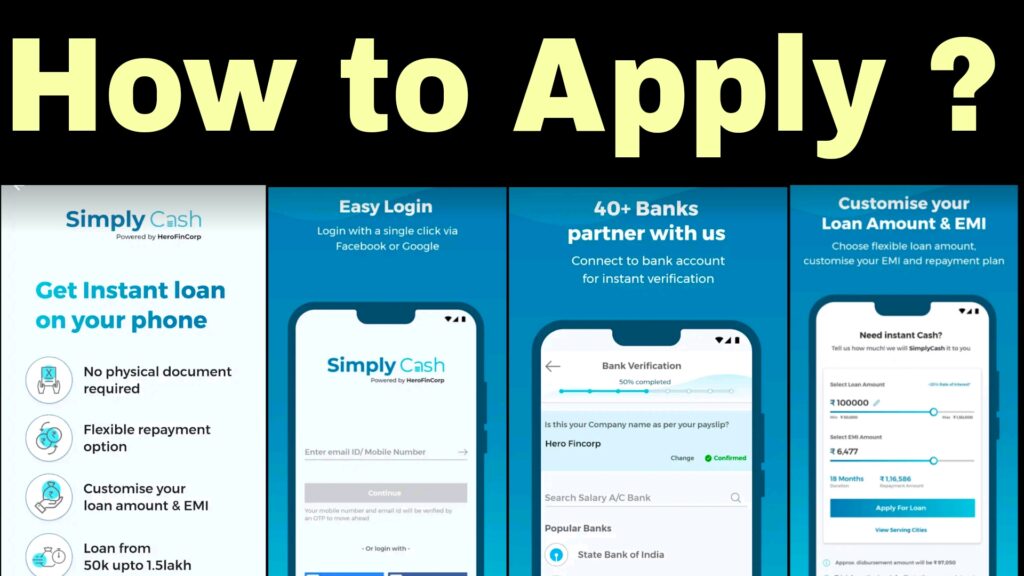

How to apply Hero Fincorp Personal loan ?

If You want to apply Hero Fincorp Personal loan then You Follow these step which is Given Below and The entire personal loan application process of Hero Fincorp is web/app-based. From sign-up to loan approval, everything takes just a few seconds ,Ag

- Step 1 – Install the SimplyCash Personal loan app from Google Play Store

- Step 2 – Choose a loan amount (up to ₹1.5 Lakh) and preferred EMI option

- Step 3 – Enter basic details like name, income, and PAN

- Step 4 – Complete your KYC process for SimplyCash loan

- Step 5 – Add your Saving or Salary bank account details

- Step 6 – Real-time approval of the SimplyCash Personal loan

- Step 7 – Digitally sign the e-mandate and loan agreement for Automatically EMI Debit

- Step 8 – Amount will be credited to your account after These Steps

Hero Fincorp loan app Customer Reviews

Hero Fincorp appCustomer Support number & Details Hero Fincorp Personal loan app customer service email :-Contact us at customer.care@herofincorp.com

- Facebook se business loan kaise le ये जानें