Credit box loan app Review || Credit box Loan Real or Fake?

Credit box loan app Review : Credit box loan app is a 7 day loan app & charge very high Rate of interest,If You wanna apply for this loan you should know about this instant loan app details. Don’t apply on this loan app if you wanna take big loan amounts like upto 1 lakh loan amounts for Decent Tenure like 12 months to 24 months with upto 36% Rate of interest

Credit Box loan app : Basic Details

- Credit box loan amount from 9000 Rupee to 90,000 Rupee but in Reality they Give only Small Amount

- Credit Box loan Tenure from 91 days to 180 day but in Reality they give only 7 day loan app don’t trust on their about section

- Affordable rate of interest rates 19% to 32% according to their about section in play store

- Service fees from 13% to 16% and GST applicable overall they charge around 50% so don’t apply on this Instant loan app

- Credit Box loan app NBFC :-PRAYATNA MICROFINANCE LIMITED which is not verified by us

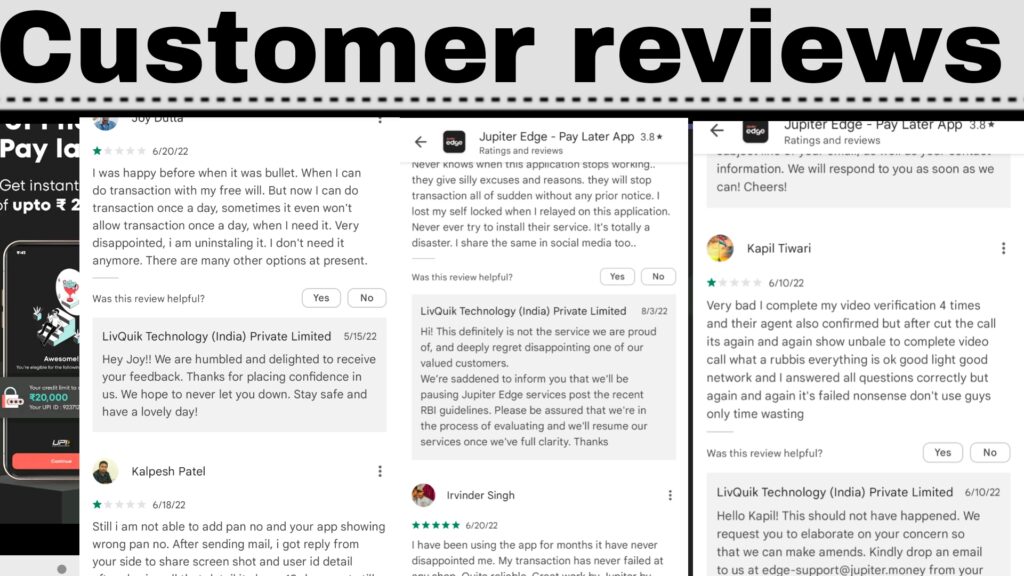

Credit Box loan app Customer reviews

- Credit box loan apps Credited loan amounts without Your Consent yes that’s a huge loan app scam

- They will Hack your Contact list and Defaming You in front of Your Family and Friends

- They Spread wrong advertising like False Claim On interest Rates,tenure,

- They give only 7 day loan which very short time tenure it’s Violations of Google Play Store policies because short term loan unauthorised

Credit Box loan Complain kaise kare?

- You Should complain on Cyber Crime online & Take Receipt of Complaint

- You can file legal complain in your nearest police station & don’t hesitate to file legal complain

- If you Already fall in the trap on 7 day loan app then you don’t need to pay a single penny of loan apps